A new low in yield was set by the FixedReset sub-index today.

Some charts will illustrate:

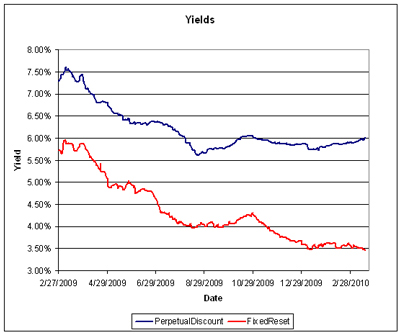

In the past year, FixedReset yields have declined from 5.72% to 3.46%, while PerpetualDiscounts have declined from 7.29% to 6.01%. Thus, the spread has widened from 157bp to 255bp – although it is dangerous and misleading to talk of the spread between these two classes, since FixedResets may now, by and large, be confidently expected to be called at the first opportunity. Thus, the basis risk that existing at the beginning of the period (more inclined to inflation protection) is not the same as the basis risk that exists now (more inclined to term spread).

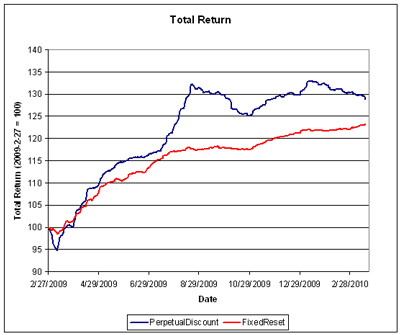

Duration and positive carry have enabled PerpetualDiscounts to outperform in the face of widening. At the current spread of 255bp and Modified Duration of 16.7, and assuming a constant future yield on FixedResets, the breakeven change in spread is a widening of about 15bp p.a.

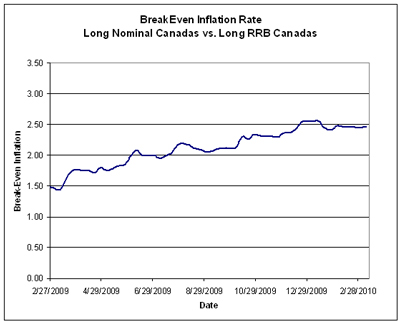

The past year’s outperformance by FixedResets in yield terms is consistent with the increase in the Breakeven Inflation Rate on Long Nominals vs. Long RRBs.

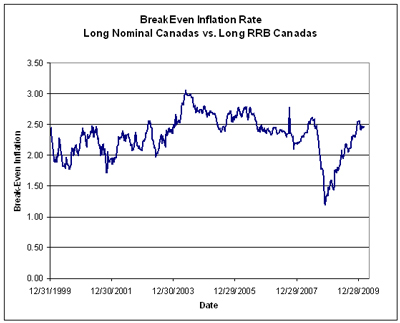

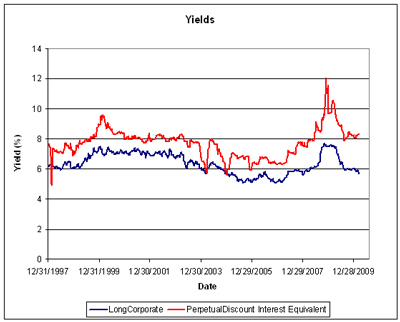

… and longer term data is consistent with the idea that this is finished.

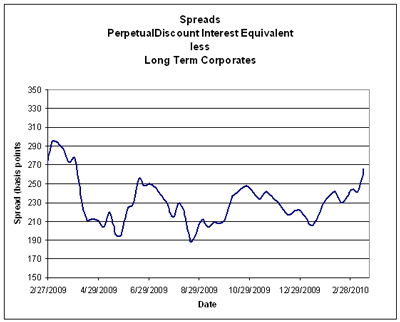

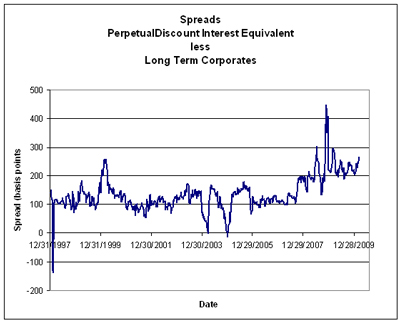

No chart for this one, but LongCorporate investors do not share any inflation fears that PerpetualDiscount investors might have; the spread between interest-equivalent PerpetualDiscounts and Long Corporates (the Seniority Spread) has increased dramatically of late.

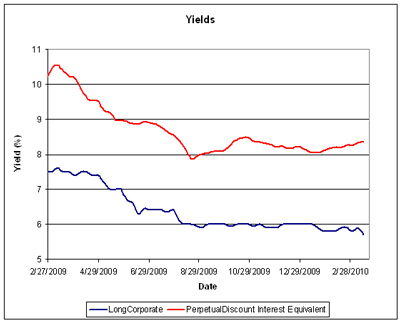

Update, 2010-3-20: OK, here are some more charts:

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « FixedReset Index Sets New Yield Low […]

Very interesting as usual but Prof. Hymas either does force his student to draw their own conclusions or expect them to reach by themselves the same as his. A few questions first:

1. I don’t understand your or the reasons for your “Modified Duration of 16.7” in your sentence under the second chart: “At the current spread of 255bp and Modified Duration of 16.7, and assuming a constant future yield on FixedResets, the breakeven change in spread is a widening of about 15bp p.a.”. Could you please explain what is meant by that and why are you using a “Modified Duration of 16.7” for Resets?

2. Why are the Long Corporate holders fearing less inflation that the holders of Perpetual Discounts? I will risk a few theories here: Is it because Long corporates holders are more likely to truly intend to hold for “30 years” or so their bonds while the “perpuity” characteristic of the Perp Discount holders make it more an instrument for “traders” more enclined to anxiety? Or could it be simply that there is not really a public market for Long Corporate Bonds while there is on for Perps (Correct me if I am wrong here but my limited knowledge of Long Corporate Bonds is that while my Discount traders offer me a price daily for buying them back from me, they take a high “commission” for that service as evidenced by the spread they candidly show for their sale price of the same product. In other words, my understanding is that there is only a secondary market for bond holders limited to the institutionnal holders such that the public fear of inflation is constricted by a less volatile market.

3. Regarding your last chart, I did note that the Spread between the Interest equivalent of Perps and Long corporates went below or touched “0%” three times (1997, 2003 and 2004). Any idea or recollection as to why it did so? Was it because of rumours of increasing tax or changes in the tax benefits of dividends?

My Thoughts looking at your charts and comments: Trying to read through the lines, my feeling is that the “haydays” of the existing fixed resets are or may be about to be over such that I should reduce my position in those taking nice capital gains. My problem with that is the usual where to put the proceeds of those then as I still think that Discount Perps will take a hit when interest rates will in did start to raise (what Mr. Market wants, Mr. Maket ultimately gets!). Obviously, the big question is for how long will this lasts since, in my layman opinion, once the Canadian directing interest rate will get back on its way to a more normal 4% (say when it reaches 2% or 2.5%) with inflation fears still high, it will probably be a good time to add to my existing Discount Perps portfolio (whose haydays too are about or might already be over for a couple of years). My big concern is, obviously, how long it will take to the market to get back to “normality” (i.e. when Mr. Market thinks that inflation and interest rates will remain what they then are for a long period) and what should I do in the meantime. The oddity with the current situation (and I wish I knew economical history better) is that interest rates are low but no one seems to believe they will stay like that for more than one or two quarter for the last 16 months or so. The situation is particularly interesting with Canadian interest rates. Either the Bank of Canada causes great harm to the Provinces of Quebec and Ontario by raising its interest rates before (I don’t think they will ever have the guts to do that) before the US Fed (What would mean the USD worth less the CAD). More likely, they will follow the US Fed at roughly the same pace but this will be still with the same result (a way too strong CAD, killing the remainder of the Ontario and Province of Quebec economies) what is not good for any Federal government who would like to be given a majority at the Parliament. So, my very long shot would be that, despite inflation, Canadian interest rates will have to remain fairly low in comparision with the rest of the world. The question is again when will this happen and for how long? This may explain why Floaters are so popular at the moment but it might be too late to get there and what a shame there is nothing of investment grade in that group (OK, the BAM I have are Pfd 2(low) but the market is and I have therefore accepted to treat those as if they were Pfd-3. So, all this to say, that I am seriously considering reducing my positions in both Fixed Reset (first and foremost) and in my Perps (I am less in a hurry with those since keeping my position might be the best thing to do 3 years down the road) buying some linked 2 or 3 years notes which would give something like inflation + 100 bps or better (I don’t know any such product yet) for the upcoming interest storm Mr. Market wants so much that I am convinced we will get.

Quite the post! I will answer in pieces at intervals.

don’t understand your or the reasons for your “Modified Duration of 16.7″

Since I specify in the rest of that note that the yield of FixedResets will be held constant in the analysis, any relative total return due to spread changes must come from a change in yield of the PerpetualDiscounts. The Modified Duration of the PerpetualDiscounts is about 16.7 ( = 1/i, where i is yield; note that for analytical purposes HIMIPref™ assigns a thirty-year term to otherwise un-called perpetuals, and therefore reports a Modified Duration that is known to be a bit low).

Over a year, the yield differential between FRs and PDs will result in PDs outperforming by 255bp unless there is a change in spreads. Since FR yields will not change (by construction) then, in order for total returns to be constant, PDs must incur an excess capital loss worth 255bp. Since the Modified Duration is 16.7, the change in yield required to produce a capital loss of 255bp is about 15bp.

If we do it the other way, and say that the yield differential must be balanced by excess capital gains on the FRs, holding PD yields constant, then, having calculated the modified duration of the FRs to be about 4.0, we can say that the yield change on the FRs must be 255 / 4.0, or about 64bp.

In other words, if (a) PD yields remain constant at about 6.00%, and (b) total returns for the next year are equal, then (c) FR yields must decline by about 64bp over the coming year and (d) therefore, FR yields in one year’s time will be about 2.82%.

Note that (c) and (d) are mathematical deductions from the assumptions (a) and (b).

Note also that the Modified Duration equation – the fundamental theorum of fixed income, as I like to call it – is true only for small, instantaneous changes in yields, neither of which condition holds for the analysis presented above. But it’s a reasonably good, quick ‘n’ dirty approximation.

Thks for this part. I am glad to see that I am no longer redirected to some football site as I was when I tried to get to your blog earlier today. I look forward to reading you on #2 and #3 and the thoughts your charts triggered in me. Having slept over what I wrote, I would clarify that I am not convinced of anything other than to say we are about to re-enter challenging times for fixed income investors…

2. Why are the Long Corporate holders fearing less inflation that the holders of Perpetual Discounts? I will risk a few theories here: Is it because Long corporates holders are more likely to truly intend to hold for “30 years” or so their bonds while the “perpuity” characteristic of the Perp Discount holders make it more an instrument for “traders” more enclined to anxiety?

At six percent, money doubles in 12 years (give or take a bit!). Therefore, in thirty years at 6%, money will almost hextuple. Therefore, the $100 principal of a thirty year bond yielding 6% is only worth about maybe $18 present value – all the rest is the value of the coupon stream.

So the difference between thirty-years and forever isn’t as much as you might think.

I think the main difference is a behavioural thing, with retail being deathly afraid of inflation and institutional being deathly afraid of underperformance.

And yes, retail dominates the preferred market, institutional dominates the bond market.

I am glad to see that I am no longer redirected to some football site as I was when I tried to get to your blog earlier today

I’m sorry about that. The hack has been fixed.

Since have begun to buy (for me) some significant amounts of preferred shares, I would appreciate a better understanding of the market for them.

Please explain the quote “retail dominates the preferred market, institutional dominates the bond market”.

Ie. Does dominates mean sets the price that significant volumes are transacted at?

Who are the “retail” investors and who are the “institutional investors”?

Does dominates mean sets the price that significant volumes are transacted at?

No, it means something more like “sets the overall price level around which fair prices are calculated.

Individual issues can drift way out of whack – until an institutional order comes in and the price moves quickly to something more fair in order to attract an offsetting order.

On the other side of the coin … PerpetualDiscounts now yield about 6.0%. That overall level is set by retail.

Who are the “retail” investors and who are the “institutional investors”?

Retail is basically anybody with a portfolio size of less than $5-million. Institutional is basically anybody with more. There may be disagreement over just where the dividing line is, but that’s where I’ll put it for the sake of an argument.

James,

1) Would the pref shares purchased by individual investors but held in mutual funds and pension funds be considerd “Retail” or “Institutional”?

2)What, in you estimation, is the percentage of the outstanding pref shares held by individual investors versus Institutional investors?

I did note that the Spread between the Interest equivalent of Perps and Long corporates went below or touched “0%” three times (1997, 2003 and 2004). Any idea or recollection as to why it did so?

Mainly beacause these are actually PerpetualPremium issues being used to construct the graph, due to the total absence of PerpetualDiscounts.

Would the pref shares purchased by individual investors but held in mutual funds and pension funds be considerd “Retail” or “Institutional”?

In terms of trading: Institutional. They have the tools, they have the size and they have the access to tht upstairs market that can move prices of individual issues around in a hurry.

It should also be noted that mutual funds are one mechanism whereby Granny Oakum’s $500 helps determine the overall level of the market.

What, in you estimation, is the percentage of the outstanding pref shares held by individual investors versus Institutional investors?

I’d guess 25%, but I’m only guessing. I’m sure there are some figures on this somewhere … maybe the IIAC?