The IMF has released the January 2012 Global Financial Stability Report:

Since the last Global Financial Stability Report (GFSR), risks to stability have increased, despite various policy steps to contain the euro area debt crisis and banking problems. European policymakers have outlined significant policy measures to address the medium-term issues contributing to the crisis, and some of these have helped to improve market sentiment, but sovereign financing remains challenging and downside risks remain. If funding challenges result in a round of deleveraging by banks, this could ignite an adverse feedback loop to euro area economies. The United States and other advanced economies are susceptible to spillovers from a potential intensification of the euro area crisis, and some have homegrown challenges to the removal of financial tail risks, including overcoming political obstacles to achieving an appropriate pace of fiscal consolidation. Developments in the euro area also threaten emerging Europe and may spill over to other emerging markets. Further policy actions are needed to restore market confidence. This effort will require building larger backstops for sovereign financing, assuring adequate bank funding and capital, and maintaining a sufficient flow of credit to the economy, possibly by establishing a “gatekeeper” charged with preventing disorderly bank deleveraging.

The euro area debt crisis has intensified further, requiring urgent action to prevent highly destabilizing outcomes.

That last sentence in the first paragraph is a good reason why I simply would not put any money into a European bank right now except as a total speculation; the politicization of European banking is getting intense. Can you imagine? If a bank wants to sell a wealth management unit, or halt lending in Greece, or something like that, they have to fill out a form and ask the regulator for permission? It may be good politics, but …

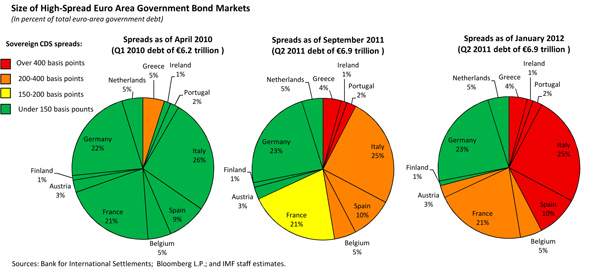

Cool graph:

Extremely slow response from my websites today led me to learn a new command-line command: pathping

Tracing route to 2a.4b.5646.static.theplanet.com [70.86.75.42]

over a maximum of 30 hops:

0 j-7da53dda1cb54 [65.95.191.3]

1 bas2-toronto08_lo0_SYMP.net.bell.ca [64.230.200.160]

2 agg1-toronto12_4-3-0_100.net.bell.ca [64.230.58.190]

3 bx5-chicagodt_xe6-1-0.net.bell.ca [64.230.186.90]

4 te1-7.bbr01.eq01.chi01.networklayer.com [206.223.119.63]

5 ae20.bbr01.eq01.dal03.networklayer.com [173.192.18.136]

6 po31.dsr02.dllstx3.networklayer.com [173.192.18.227]

7 * * *

Computing statistics for 175 seconds…

Source to Here This Node/Link Hop RTT Lost/Sent = Pct Lost/Sent = Pct Address

0 j-7da53dda1cb54 [65.95.191.3] 0/ 100 = 0% |

1 11ms 0/ 100 = 0% 0/ 100 = 0% bas2-toronto08_lo0_SYMP.net.bell.ca [64.230.200.160] 0/ 100 = 0%

2 12ms 0/ 100 = 0% 0/ 100 = 0% agg1-toronto12_4-3-0_100.net.bell.ca [64.230.58.190] 0/ 100 = 0%

3 26ms 0/ 100 = 0% 0/ 100 = 0% bx5-chicagodt_xe6-1-0.net.bell.ca [64.230.186.90] 100/ 100 =100% |

4 – 100/ 100 =100% 0/ 100 = 0% te1-7.bbr01.eq01.chi01.networklayer.com [206.223.119.63]0/ 100 = 0%

5 – 100/ 100 =100% 0/ 100 = 0% ae20.bbr01.eq01.dal03.networklayer.com [173.192.18.136]0/100 = 0%

6 – 100/ 100 =100% 0/ 100 = 0% po31.dsr02.dllstx3.networklayer.com [173.192.18.227] 0/ 100 = 0%

7 – 100/ 100 =100% 0/ 100 = 0% j-7da53dda1cb54 [0.0.0.0] Trace complete.

Looks like Bell was having some major problems connecting with the world!

It was a very good day for the Canadian preferred share market, with PerpetualDiscounts winning 40bp, FixedResets gaining 15bp and DeemedRetractibles up 20bp. All entries on the Performance Highlights table are winners. Volume was average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5910 % | 2,381.0 |

| FixedFloater | 4.68 % | 4.05 % | 41,874 | 17.30 | 1 | 0.4950 % | 3,332.1 |

| Floater | 2.80 % | 2.97 % | 66,969 | 19.79 | 3 | 0.5910 % | 2,570.8 |

| OpRet | 4.93 % | 1.15 % | 64,752 | 1.31 | 7 | 0.1149 % | 2,505.4 |

| SplitShare | 5.31 % | 0.49 % | 68,143 | 0.87 | 4 | 0.6245 % | 2,636.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1149 % | 2,291.0 |

| Perpetual-Premium | 5.41 % | -9.44 % | 86,004 | 0.09 | 23 | -0.0108 % | 2,211.9 |

| Perpetual-Discount | 5.01 % | 4.99 % | 163,344 | 15.49 | 7 | 0.4015 % | 2,416.3 |

| FixedReset | 5.03 % | 2.70 % | 207,716 | 2.35 | 65 | 0.1512 % | 2,386.5 |

| Deemed-Retractible | 4.89 % | 3.32 % | 200,243 | 1.29 | 46 | 0.1973 % | 2,311.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SLF.PR.D | Deemed-Retractible | 1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.05 Bid-YTW : 5.54 % |

| SLF.PR.C | Deemed-Retractible | 1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.99 Bid-YTW : 5.58 % |

| GWO.PR.N | FixedReset | 1.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.32 Bid-YTW : 3.47 % |

| BAM.PR.B | Floater | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-24 Maturity Price : 17.75 Evaluated at bid price : 17.75 Bid-YTW : 2.97 % |

| TRP.PR.A | FixedReset | 1.67 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-31 Maturity Price : 25.00 Evaluated at bid price : 26.74 Bid-YTW : 2.26 % |

| BNA.PR.E | SplitShare | 2.07 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.60 Bid-YTW : 5.33 % |

| ELF.PR.G | Perpetual-Discount | 2.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-24 Maturity Price : 22.21 Evaluated at bid price : 22.51 Bid-YTW : 5.30 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.F | FixedReset | 344,331 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-24 Maturity Price : 23.19 Evaluated at bid price : 25.29 Bid-YTW : 3.78 % |

| BAM.PR.R | FixedReset | 236,296 | RBC crossed four blocks: 100,000 shares, 30,000 shares, 10,000 and 68,200, all at 26.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-24 Maturity Price : 23.55 Evaluated at bid price : 26.20 Bid-YTW : 3.75 % |

| SLF.PR.I | FixedReset | 96,723 | TD bought 10,000 from anonymous, then crossed 11,900 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 4.32 % |

| TCA.PR.X | Perpetual-Premium | 83,551 | Nesbitt crossed 80,000 at 52.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-10-15 Maturity Price : 50.00 Evaluated at bid price : 52.00 Bid-YTW : 3.16 % |

| SLF.PR.A | Deemed-Retractible | 78,953 | Nesbitt crossed 62,100 at 23.90. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.95 Bid-YTW : 5.37 % |

| SLF.PR.D | Deemed-Retractible | 70,121 | Nesbitt crossed 45,900 at 22.90. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.05 Bid-YTW : 5.54 % |

| There were 30 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.E | Perpetual-Premium | Quote: 25.61 – 26.25 Spot Rate : 0.6400 Average : 0.4619 YTW SCENARIO |

| IAG.PR.F | Deemed-Retractible | Quote: 26.27 – 26.60 Spot Rate : 0.3300 Average : 0.2286 YTW SCENARIO |

| CIU.PR.B | FixedReset | Quote: 27.65 – 27.95 Spot Rate : 0.3000 Average : 0.2233 YTW SCENARIO |

| TCA.PR.Y | Perpetual-Premium | Quote: 52.06 – 52.46 Spot Rate : 0.4000 Average : 0.3244 YTW SCENARIO |

| MFC.PR.B | Deemed-Retractible | Quote: 24.03 – 24.31 Spot Rate : 0.2800 Average : 0.2055 YTW SCENARIO |

| FTS.PR.G | FixedReset | Quote: 25.95 – 26.23 Spot Rate : 0.2800 Average : 0.2204 YTW SCENARIO |