The latest regulatory extortion attempt worked:

A New York regulator settled a money laundering probe of Standard Chartered Plc (STAN) for $340 million a day before the U.K.-based bank was to appear at a hearing to defend its right to continue operating in the state.

Do I see the beginnings of a backlash?

Add it all up and it’s hard to avoid the impression Mr. Lawsky just carried out an effective old-fashioned shakedown, and one that also happens to be good politics in a bank-bashing era. Either way, he has just served notice that yet another regulator has its eye on Wall Street – and that banking in New York may now carry even more frictional costs than the industry bargained for.

William C. Dudley, president of the Federal Reserve Bank of New York, writes an excellent piece on Money Market Fund reform:

Contrary to what some in the industry suggest, run risk didn’t end when the SEC sensibly tightened rules on money-fund holdings in 2010. Analysis by the U.S. Treasury’s Office of Financial Research showed that, as of April this year, no fewer than 105 money-market funds with more than $1 trillion in assets were at risk of breaking the buck if any one of their top 20 borrowers were to default.

The SEC’s Schapiro would address run risk by requiring money funds to move to floating net-asset values (like most other mutual funds) or to adopt capital buffers, possibly along with redemption restrictions.

Floating net-asset values would be a significant improvement over stable net-asset values. It would reduce the incentive for shareholders to get out early in times of stress. But it wouldn’t eliminate the incentive to run altogether. Fund managers faced with large redemption requests typically sell their most liquid assets first, leaving the remaining investors with a riskier, less-liquid portfolio and a greater risk of loss.

As explained in a recent paper by Federal Reserve economists, combining small capital buffers with a requirement that investors who withdraw funds must maintain a small balance for a short period to absorb near-term losses would make the system safer by creating a disincentive to run. The modest withdrawal restrictions, which create a “minimum balance at risk,” might be set at 5 cents on the dollar, based on the high- water mark of recent holdings.

Crucially, the minimum balance retained by those who had pulled money out would be put in the first-loss position for about 30 days. This would protect those who remain in the fund from losses caused by others’ redemptions. Exemptions for small investors, who are least likely to run, could be considered. For instance, the first $50,000 of an investor’s redemptions could be exempt from first loss. Small investors would share proportionately in any fund losses instead.

He references the Treasury’s Office of Financial Research Annual Report (didn’t know there was one of those):

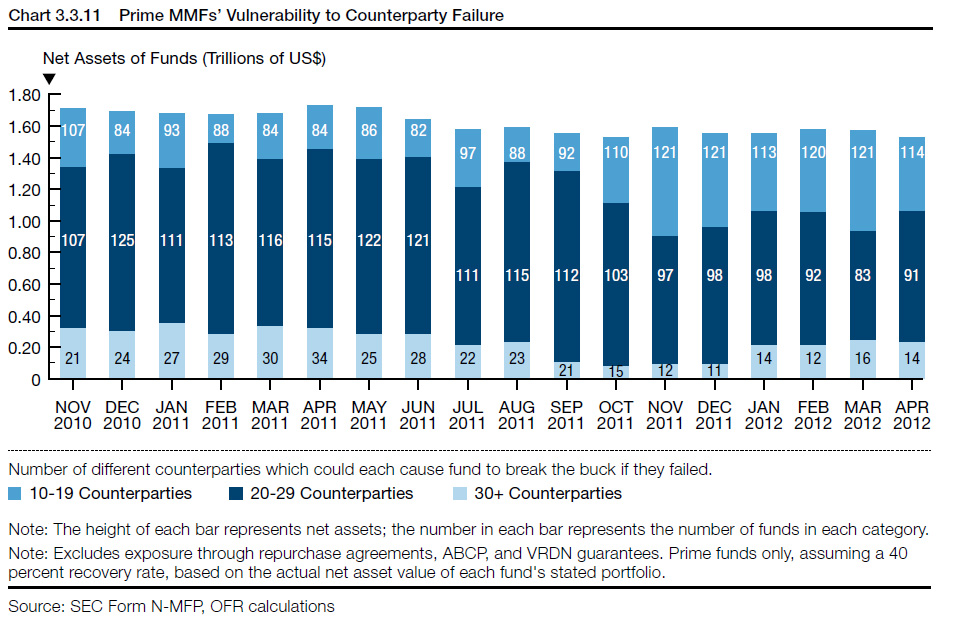

Chart 3.3.11 illustrates counterparty concentration among money market funds. The chart shows the vulnerability of funds to a default of their counterparties. The most vulnerable funds would break the buck—fall below the $1 net asset value by more than half a cent—if any one of 30 or more counterparties defaulted; the less vulnerable funds would break the buck if any one of 10 to 19 counterparties defaulted. The analysis assumes 40 percent recovery on all unsecured lending by the funds and full recovery on all repo transactions.

The other paper highlighted is by Patrick E. McCabe, Marco Cipriani, Michael Holscher, and Antoine Martin, titled The Minimum Balance at Risk: A Proposal to Mitigate the Systemic Risks Posed by Money Market Funds:

This paper introduces a proposal for money market fund (MMF) reform that could mitigate systemic risks arising from these funds by protecting shareholders, such as retail investors, who do not redeem quickly from distressed funds. Our proposal would require that a small fraction of each MMF investor’s recent balances, called the “minimum balance at risk” (MBR), be demarcated to absorb losses if the fund is liquidated. Most regular transactions in the fund would be unaffected, but redemptions of the MBR would be delayed for thirty days. A key feature of the proposal is that large redemptions would subordinate a portion of an investor’s MBR, creating a disincentive to redeem if the fund is likely to have losses. In normal times, when the risk of MMF losses is remote, subordination would have little effect on incentives. We use empirical evidence, including new data on MMF losses from the U.S. Treasury and the Securities and Exchange Commission, to calibrate an MBR rule that would reduce the vulnerability of MMFs to runs and protect investors who do not redeem quickly in crises.

Wells Fargo issued some preferreds in the States (no dividend tax credit!) rated A by DBRS:

DBRS has today assigned a rating of ‘A’ with a Stable trend to Wells Fargo & Company’s (Wells Fargo or the Company) $675 million issuance (with a $75 million over-allotment option) of Non-cumulative Perpetual Preferred Stock. The ratings are positioned three notches below Wells Fargo’s Issuer & Senior Debt rating of AA, which also carries a Stable trend. This notching is consistent with DBRS’s base notching policy for preferred shares issued for AA rated entities.

They’re financing at 5.25% to redeem at 8.25%.

State Street Corporation (NYSE: STT) today announced the pricing of its previously announced offering of 20,000,000 depositary shares each representing a 1/4,000th ownership interest in a share of Non-Cumulative Perpetual Preferred Stock, Series C, without par value per share, with a liquidation preference of $100,000 per share (equivalent to $25 per depositary share). The aggregate dollar amount of the depositary shares offered is $500,000,000. The offering is being conducted pursuant to an effective registration statement under the Securities Act of 1933.

The depositary shares will be offered to the public at a price of $25 per depositary share and with a dividend rate of 5.25% per annum on the liquidation preference of $100,000 per Series C share.

…

Subject to approval by the Federal Reserve, State Street intends to use the net proceeds of the offering to redeem all of the outstanding shares of State Street’s Non-Cumulative Perpetual Preferred Stock, Series A, all of which are held by State Street Capital Trust III, at a cash redemption price of $100,000 per share, together with an amount equal to any dividends that have been declared but not paid prior to the redemption date, on such redemption date as may be established by State Street in accordance with the Certificate of Designation of the Series A Preferred Stock. Upon the completion of the redemption of the Series A Preferred Stock, State Street Capital Trust III will redeem all of State Street’s outstanding 8.250% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities and all of the outstanding common securities issued by State Street Capital Trust III. If State Street is not permitted to redeem the Series A Preferred Stock, then State Street expects to use the net proceeds for general corporate purposes.

Redemption provisions aren’t all that good according to the prospectus:

The Series N Preferred Stock may be redeemed by us at our option in whole, or in part, on September 15, 2017, or any dividend payment date thereafter, at a redemption price equal to $25,000 per share of Series N Preferred Stock (equivalent to $25 per depositary share), plus an amount equal to any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series N Preferred Stock may also be redeemed by us at our option in whole, but not in part, prior to September 15, 2017, upon the occurrence of a “regulatory capital treatment event,” as described herein, at a redemption price equal to $25,000 per share of Series N Preferred Stock (equivalent to $25 per depositary share), plus an amount equal to any declared and unpaid dividends, without accumulation of any undeclared dividends.

I do like linking to public documents on public file as filed with the regulator of record! So much better than what we have here in Canada.

Atlantic Power, proud ultimate parent of AZP.PR.A and AZP.PR.B, was confirmed at Pfd-4 by DBRS:

DBRS has today confirmed the ratings of Senior Unsecured Debt and Medium-Term Notes (the Notes) of Atlantic Power Limited Partnership (APLP; formerly Capital Power Income L.P.) and the Cumulative Preferred Shares of Atlantic Power Preferred Equity Ltd. (formerly CPI Preferred Equity Ltd.) at BB and Pdf-4, respectively, both with Stable trends. The rating of APLP is based on the credit quality of Atlantic Power Corporation (ATP or the Company; not rated by DBRS) given that APLP guarantees the majority of ATP’s debt at the holding company level (total holding company debt at ATP accounted for 36% of consolidated debt, June 30, 2012). The recovery rating of the Notes is RR4 (indicating an expected recovery of 30% to 50%).

The credit profile of ATP reflects its moderate business risk profile, which benefits from a diversified portfolio of generation assets (2,141 megawatts of net generating capacity) located in 11 states in the U.S. and two provinces in Canada. Over 95% of its net generating capacity is under power contracts (PPAs), with a significant portion of contracted capacity having capacity payments and fuel cost pass-through. PPAs substantially reduce ATP’s exposure to wholesale power price volatility and support cash flow stability. In addition, ATP has above-average operational efficiency with a capacity factor of over 90% (five-year average), which is key to maintaining steady capacity payments.

Following the acquisition of APLP, ATP’s financial profile weakened significantly, predominately due to higher leverage and weaker cash flow ratios. ATP’s balance sheet is expected to continue to be pressured by the ongoing high level of capex associated with the Canadian Hills and Piedmont Green Power projects in 2012. In the medium to long term, APT’s financing strategy is to reduce the consolidated debt-to-capital ratio (currently at 67%) to 50%. Should the Company successfully execute its deleveraging strategy and build a strong track record of maintaining a good financial profile, this will have a positive credit implication.

It was a good, if uneven, day for the Canadian preferred share market, as PerpetualPremiums won 11bp, FixedResets were flat and DeemedRetractibles gained 8bp. Volatility was negligible. Volume continued to be awful.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3785 % | 2,328.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3785 % | 3,482.5 |

| Floater | 3.13 % | 3.17 % | 63,232 | 19.27 | 3 | 0.3785 % | 2,513.7 |

| OpRet | 4.75 % | 2.36 % | 34,499 | 0.85 | 5 | 0.1226 % | 2,538.4 |

| SplitShare | 5.46 % | 5.08 % | 66,089 | 4.62 | 3 | -0.0133 % | 2,772.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1226 % | 2,321.2 |

| Perpetual-Premium | 5.30 % | 4.05 % | 102,127 | 1.13 | 28 | 0.1064 % | 2,275.6 |

| Perpetual-Discount | 4.97 % | 4.97 % | 95,928 | 15.48 | 3 | 0.1816 % | 2,517.0 |

| FixedReset | 4.99 % | 3.03 % | 174,761 | 3.97 | 71 | 0.0011 % | 2,423.6 |

| Deemed-Retractible | 4.95 % | 3.34 % | 133,022 | 1.17 | 46 | 0.0834 % | 2,356.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ELF.PR.H | Perpetual-Premium | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-17 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 5.07 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FTS.PR.G | FixedReset | 53,890 | Scotia crossed blocks of 10,000 and 25,000, both at 25.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-08-14 Maturity Price : 24.08 Evaluated at bid price : 25.47 Bid-YTW : 3.46 % |

| ENB.PR.N | FixedReset | 44,837 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-08-14 Maturity Price : 23.18 Evaluated at bid price : 25.27 Bid-YTW : 3.84 % |

| TD.PR.E | FixedReset | 38,774 | TD crossed blocks of 18,100 and 20,000, both at 26.62. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-30 Maturity Price : 25.00 Evaluated at bid price : 26.61 Bid-YTW : 2.52 % |

| BMO.PR.O | FixedReset | 38,002 | TD crossed two blocks of 18,000 each at 26.72. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 26.71 Bid-YTW : 2.44 % |

| PWF.PR.M | FixedReset | 37,025 | TD crossed 34,700 at 26.34. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.20 Bid-YTW : 2.80 % |

| FTS.PR.F | Perpetual-Premium | 33,145 | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-12-01 Maturity Price : 25.00 Evaluated at bid price : 25.92 Bid-YTW : 4.05 % |

| There were 13 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| RY.PR.Y | FixedReset | Quote: 26.81 – 27.06 Spot Rate : 0.2500 Average : 0.1535 YTW SCENARIO |

| GWO.PR.M | Deemed-Retractible | Quote: 26.46 – 26.70 Spot Rate : 0.2400 Average : 0.1568 YTW SCENARIO |

| PWF.PR.O | Perpetual-Premium | Quote: 26.40 – 26.75 Spot Rate : 0.3500 Average : 0.2722 YTW SCENARIO |

| ELF.PR.G | Perpetual-Discount | Quote: 23.43 – 23.73 Spot Rate : 0.3000 Average : 0.2239 YTW SCENARIO |

| TRP.PR.A | FixedReset | Quote: 25.71 – 26.00 Spot Rate : 0.2900 Average : 0.2201 YTW SCENARIO |

| SLF.PR.B | Deemed-Retractible | Quote: 24.21 – 24.46 Spot Rate : 0.2500 Average : 0.1831 YTW SCENARIO |

[…] don’t like the “Minimum Balance at Risk” proposal (discussed on August 14, 2012), but the capital buffer idea is long overdue. I am not terribly enthusiastic about their idea that […]

[…] preferred share issues were confirmed at Pfd-4 by DBRS last August, as reported on 2012-8-14. Following the acquisition of APLP, ATP’s financial profile weakened significantly, predominately […]