It’s a Fed-Watching Frenzy!

“The minutes largely reiterated what the chairman said in June,” Ryan Larson, the Chicago-based head of U.S. equity trading at RBC Global Asset Management (U.S.) Inc., said by e-mail. His firm oversees $290 billion. “Tapering, whether it will be this year or next, is inevitable. The market was initially encouraged that the Fed is waiting on additional data, but possibly taken aback by the fact that about half the participants indicated that asset purchases should end later this year.”

Minutes from the central bank’s June 18-19 meeting, released today in Washington, showed that while several members judged that a reduction in asset purchases “would likely soon be warranted,” many officials want to see more signs employment is picking up before they’ll begin slowing the pace of $85 billion in monthly bond purchases.

The Globe was a bit more colourful:

The minutes show there was an intense debate about how to communicate the Fed’s intentions. A minority of policy makers are worried that the Fed’s policies are too aggressive, risking inflation and asset-price bubbles, and should be reversed as soon as possible. And among the supporters of more QE, there was a feeling that the central bank should nonetheless send the message that economic conditions were improving, heralding an eventual end to the bond-buying program.

It was decided that Mr. Bernanke should attempt to lay out a path for QE at the press conference that followed the meeting. That’s when he told reporters that if the economic outlook held, the Fed likely would slow its bond purchases later in 2014 and end the program in the middle of 2015, when the unemployment rate likely will have fallen to about 7 per cent.

Stock markets plunged immediately, as traders the world over largely disregarded Mr. Bernanke’s insistence that the Fed also could boost asset purchases if the economy failed to unfold as expected.

BIS has published a paper titled Analysis of risk-weighted assets for credit risk in the banking book:

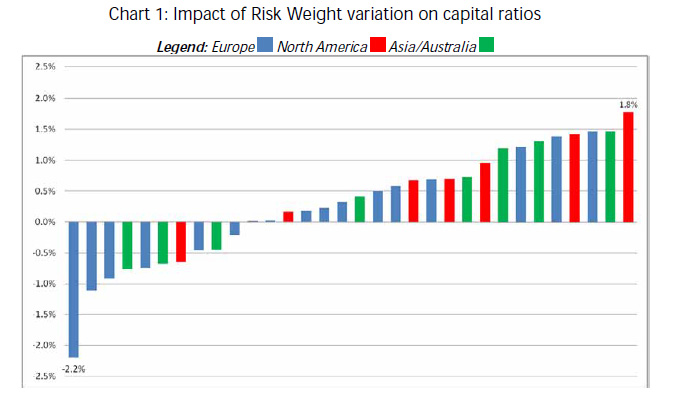

The bottom-up portfolio benchmarking exercise (the hypothetical portfolio exercise, or HPE), under which banks were asked to evaluate the risk of a common set of (largely low-default) wholesale obligors and exposures, revealed notable dispersion in the estimates of PD and LGD assigned to the same exposures. The three wholesale asset classes covered by the HPE analysis (sovereign, bank, and corporate) account on average for about 40% of participating banks’ total credit RWAs. A rough translation of the implied risk weight variations into potential impact on banks’ capital ratios suggests that the impact could be material; at the extremes, capital ratios could vary by as much as 1.5 to 2 percentage points (or 15 to 20% in relative terms) in either direction around the 10% benchmark used for this study. However, most of the banks (22 of the 32 participating banks) lie within one percentage point of that benchmark (see Chart 1 below).

Click for Big

Change from 10% capital ratio if individual bank risk weights from the HPE are adjusted to the median from the sample. Each bar represents one bank. The chart is based on the assumption that variations observed at each bank for the hypothetical portfolios are representative for the entire sovereign, bank, and corporate portfolios of the bank and are adjusted accordingly. No other adjustments are made to RWA or capital.

A reader brings to my attention a debunking of green disinformation:

- The “Gas Town Steam Clock” is not powered by steam

- The iconic wind turbine at Grouse Mountain is an energy sink

- BC Hydro’s emissions reporting is highly misleading

- Vancouver is nowhere as near as green as it likes to thing it is

I left this one out yesterday: DBRS confirmed RY at Pfd-1(low), although its NVCC-compliant RY.PR.W is still under Review-Negative:

RBC’s diversified business model and geographic profile have provided the Bank with consistently strong profitability and return on equity throughout various business and credit cycles. RBC is the largest retail bank in Canada and currently holds first or second-ranking positions in each business it participates in domestically, with an objective to become the leader in every business. The Bank continues to build on its leading market positions within Canada and is expanding its presence globally, particularly in wealth management and capital markets, where the Bank has been increasing its market share among the top global banks.

Despite strong performance in recent years, continued long-term domestic growth within Canada is expected to be a challenge given the Bank’s significant market share positions, the mature Canadian banking industry and the competitive landscape. Domestically, RBC and its large competitors have little room to grow beyond market growth rates, which have been strong in recent years. Additionally, foreign banks that previously exited the domestic market during the crisis have re-emerged as competitors.

DBRS does not expect potential house price depreciation in Canada to result in material losses from the Bank’s real estate secured lending portfolio, notwithstanding the high indebtedness of the average Canadian consumer and significant increases in housing prices in certain sectors of the Canadian real estate market.

The rating on the Non-Cumulative First Preferred Shares, Series W remains Under Review with Negative Implications. DBRS hopes to resolve this rating in the near future after the publication of the results from DBRS’s recent Request for Comments on Rating Subordinated, Hybrids and Preferred Bank Capital Securities

It was another day of retreat for the Canadian preferred share market, with PerpetualDiscounts losing 24bp, FixedResets off 8bp and DeemedRetractibles down 13bp. The Performance Highlights table was at average length – it hasn’t been average for a while!

PerpetualDiscounts now yield 5.41%, equivalent to 7.03% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.65%, so the pre-tax interest-equivalent spread (in this context, the Seniority Spread) is now about 240bp, unchanged from the figure reported July 3.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.5062 % | 2,561.9 |

| FixedFloater | 4.23 % | 3.57 % | 41,662 | 18.12 | 1 | -0.1779 % | 3,880.9 |

| Floater | 2.74 % | 2.94 % | 84,173 | 19.90 | 4 | -0.5062 % | 2,766.2 |

| OpRet | 4.81 % | 2.08 % | 77,228 | 0.71 | 4 | 0.0097 % | 2,616.2 |

| SplitShare | 4.67 % | 4.28 % | 70,619 | 3.95 | 6 | -0.1368 % | 2,969.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0097 % | 2,392.2 |

| Perpetual-Premium | 5.63 % | 4.60 % | 102,398 | 0.79 | 12 | -0.0928 % | 2,277.7 |

| Perpetual-Discount | 5.39 % | 5.41 % | 142,637 | 14.77 | 26 | -0.2398 % | 2,389.0 |

| FixedReset | 4.96 % | 3.50 % | 237,865 | 3.38 | 83 | -0.0814 % | 2,481.2 |

| Deemed-Retractible | 5.06 % | 4.53 % | 178,192 | 7.03 | 43 | -0.1258 % | 2,385.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.F | Perpetual-Discount | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 23.05 Evaluated at bid price : 23.46 Bid-YTW : 5.27 % |

| ELF.PR.H | Perpetual-Premium | -1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 24.05 Evaluated at bid price : 24.44 Bid-YTW : 5.64 % |

| BAM.PR.B | Floater | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 17.94 Evaluated at bid price : 17.94 Bid-YTW : 2.94 % |

| SLF.PR.G | FixedReset | -1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.46 Bid-YTW : 3.70 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.H | Deemed-Retractible | 305,615 | TD crossed blocks of 250,000 and 48,600, both at 23.80. Nice tickets! YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.72 Bid-YTW : 5.50 % |

| BNS.PR.Q | FixedReset | 160,395 | RBC crossed blocks of 50,000 and 100,000, both at 25.00. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.95 Bid-YTW : 3.58 % |

| BAM.PR.N | Perpetual-Discount | 143,422 | Desjardins crossed blocks of 50,000 and 83,300, both at 21.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 21.24 Evaluated at bid price : 21.24 Bid-YTW : 5.64 % |

| RY.PR.X | FixedReset | 139,715 | RBC crossed 40,000 and 59,600, both at 26.23. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 26.24 Bid-YTW : 2.49 % |

| TD.PR.S | FixedReset | 137,785 | Reset rate announced. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.76 Bid-YTW : 3.59 % |

| ENB.PR.F | FixedReset | 56,221 | National crossed 24,700 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-07-10 Maturity Price : 23.12 Evaluated at bid price : 24.86 Bid-YTW : 4.21 % |

| There were 64 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.F | Deemed-Retractible | Quote: 25.30 – 25.59 Spot Rate : 0.2900 Average : 0.1902 YTW SCENARIO |

| TCA.PR.X | Perpetual-Discount | Quote: 49.70 – 50.00 Spot Rate : 0.3000 Average : 0.2132 YTW SCENARIO |

| PWF.PR.O | Perpetual-Premium | Quote: 25.45 – 25.78 Spot Rate : 0.3300 Average : 0.2453 YTW SCENARIO |

| BNA.PR.E | SplitShare | Quote: 25.70 – 26.00 Spot Rate : 0.3000 Average : 0.2182 YTW SCENARIO |

| SLF.PR.A | Deemed-Retractible | Quote: 23.13 – 23.39 Spot Rate : 0.2600 Average : 0.1798 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 24.16 – 24.55 Spot Rate : 0.3900 Average : 0.3101 YTW SCENARIO |

It’s more than a Fed-watching frenzy, I’m afraid.

Ever since Lehman Bros., the market has grown increasingly persistent on making headline trading the top priority. After that one came Greece, then Fiscal Cliff, sometimes China economy, now Tapering.

At the end of the day, Canadian banks and big oil will earn $1B+/qtr regardless of the outcome of these so-called issues. Preferred shares will continue to pay dividends, and virtually all underlying corporate conditions will for the most part be unaffected, here and abroad. But gold will move in increments of $100’s/dollars per ounce, bond yields will move in 50 bps blocks, oil will trade in daily ranges sometimes up to $5.00/bbl . . . and the short sellers will zap the energy and interest of true investors like squirrels emptying your bird feeder.

I think the Bernankes of the world should spend more time using the “tools in their toolboxes”, and less time in front of microphones, and maybe, just maybe, stocks, bonds, commodities, . . . and preferred shares could start to resume trading on corporate fundamentals, instead of headline shock and awe.

Sorry about the rant, James . . . but this Bernanke/tapering saga is starting to get to me.

Certainly tapering is the flavour of the month; but there has been a flavour of the month every month since the first security was traded.

In my experience, most portfolio managers don’t have a clue what they’re doing, so they decide on a theme, test it with varying degrees of competence and honesty and then make a macro-decision, sticking with it until something happens to make them change their theme (for some of these guys, it’s a change in wind direction; for others, its the bankruptcy of their clients).

Results have little, if anything, to do with the investment management business. It’s all sales.

I’m all for volatility and heavy trading on themes. Sometimes they go against me – until fundamentals reassert themselves – but sometimes they create opportunities for a long-term disciplined investor.

Yes; I would agree with everything you’ve said there . . . including the opportunity through volatility part.

If, in fact, what you say about portfolio managers is bang on, I wonder how they manage to continue to earn paychecks. Between their unimpressed bosses, and their angry clients, how can they continue to be funded? The fact is, you are bang on, and people continue to throw money at these people. I just don’t get it sometimes.

Thank you for bringing my blood pressure down a few beeps! Should be a good day in all categories, including prefs . . . thanks to Bernanke’s bantering yesterday!

Between their unimpressed bosses, and their angry clients, how can they continue to be funded?

Typically, their bosses don’t care, because investment management is not an important activity for the company: the business of the company is sales and the necessity of hiring a portfolio manager is simply an unfortunate cost of doing business.

The clients don’t care, because clients don’t care about performance. Clients want a firm handshake, an impressive-sounding story and a brand-name company.

Hmmmm . . . I agree with your first point, but I think, at least increasingly, clients are at least starting to care.

If you hand over say $10,000 to the handshaking, brand-name company, and your first statement shows a net value of $9,000, you gotta care. OK, tough market conditions, long term approach, etc. . . . but a year later, your account’s now down to $8,000 . . . you gotta care, or you’re not too bright.

“Clients don’t care about performance” . . . geez, you’re right in the business; is this actually true to some degree? . . . I really don’t want to have to believe it, but maybe I do? Wow . . . this is a revelation moment, James. I know you believe in “buy low, sell high”, but what you’re saying is very few people on either side of the equation do as well.

Clients have a very difficult time differentiating between market performance and their personal performance.

In your example, then if the index indicated that the account value would normally have been $7,000 after a year, then the client has a good advisor (or, at least, one who got lucky for the first year, which is actually more probable). If the account value should have been $9,000, then the opposite applies.

Clients don’t want to talk about long term cash flow needs for their account, because all that’s boring. They want to know what’s going to go up, preferably a lot, preferably tomorrow, because that’s what advisors are for; after all, when they’re on TV – the acid test of a knowledgable and skilled person, right? – that’s what gets talked about.

And if the portfolio doesn’t increase in value … well, look what happened! Nobody could have predicted THAT!

Look at my G&M live chat. Basically all the questions were about market timing. There wasn’t a single one on ‘how should a client with X needs structure a preferred portfolio with Y dollars?’

So what do advisors and portfolio managers do? They can’t predict the market, although a lot of them like to think they can. So they do what they can, which in most cases is the only thing they can do: pick a theme that has a good story, structure the portfolio so there’s a few good stories in there that tie into the theme … and get out there and SELL!

You should also be aware that the regulators don’t have a clue about performance measurement, basically because they’re too fucken stupid to understand high school math.

Consider Dollar Weighted Returns. This has absolutely no relationship to advisor skill whatsoever, but is now a mandatory performance measurement requirement (or soon will be, I forget which) on client statements.

And this mandatory measure is cheered on by pig-ignorant bozos making a nice living for themselves as “Investor Advocates”.

Also, look at the prospectus rules for funds. The experience, in terms of years, is given for the portfolio managers. There’s not a word about past performance, honestly measured, against honestly chosen indices.

I know guys who have been in this business for 20-30 years and list that as their experience. The fact that this experience has consisted almost exclusively of vapourizing client money is irrelevant.

Good morning James,

Thank you for the assorted responses here (you don’t have a problem with any aspects of this industry, do you?!). Very excellent insights by you here! I tend to agree pretty much wholeheartedly with the relative uselessness of so much of the financial services sector, as you appear to subscribe to as well.

I love this one the most though . . . let me see if I understand this correctly: You invest $10K at the beginning of the year in a mutual fund . . . indexes that are relevant to your particular fund show a down year, one that would have your investments sitting at about $7K a year later . . . however, your account is actually worth $8K, so for this reason, your investment advisor outperformed the market, and he/she is a genius!

So I should call this advisor up, thank them for delivering a 20% loss for me, and be delighted?!

And you are suggesting that the majority of “investors” really subscribe to this line of thought, and hence, getting back to your original point, don’t really care about real returns, just the handshake and the story.

James, you know what you’re really implying with this, right? . . . that the majority of people who entrust their cash to “institutional” investors are, well, not too bright . . . or at the very least, so unable to manage their own situation, that they’re willing to accept professionally managed losses, as an alternative to accepting potentially higher personally created losses.

Hmmmm . . . I gotta think about this a bit more . . .

So I should call this advisor up, thank them for delivering a 20% loss for me, and be delighted?!

Probably. Because he outperformed the market by 1000bp, a very significant win.

Before making the call, though, you should achieve some understanding of how he did it. If it seems sensible and reproducible, that’s good; but such extreme outperformance is usually the result of wild bets that won and which have no implications for the future.

A good advisor can help you put together a portfolio that meets your needs, based on the long-term characteristics of each asset class. A really good advisor can attempt to choose the ‘best of breed’ within each asset class; not getting it right every time, but being right often enough to make the exercise worth-while.

A charlatan will tell you he has an uncanny skill at timing the market and tell you an entirely true story about how he pulled client XYZ out of stocks in early 2008 and put them back in in early 2009. He will not tell you about the clients for which the reverse was true; nor will he talk about his other failures, nor will he provide a long term audited composite performance report.

John Paulson is the current poster-boy for this management style. He has billions under management and has made billions for himself, which is why this management style is so popular.

Clients will flock to the charlatans, because who wants to lose 20% on the market? It’s better, they say, to find somebody with uncanny skill at market timing.

James, you know what you’re really implying with this, right? . . . that the majority of people who entrust their cash to “institutional” investors are, well, not too bright

Yeah, that’s a succinct way of putting it.

Good morning, James . . .

first of all, thank you for the dialogue; I do appreciate it . . . and secondly, thank you for the very, very candid and honest answers here. It is not lost on me that you are, in fact, a “mutual fund manager” of sorts yourself (not intended as an insult, btw!), and nothing you’ve put up here is in the least, self-serving. I might have to consider an investment with you, simply because, you probably deserve it!

Now, back to this comment:

“Probably. Because he outperformed the market by 1000bp, a very significant win. ”

To extrapolate that then, it sounds like you’re saying that, as an investor, I need to decide, on my own, which way the market will be going, before I take on any kind of “investment advisor”. I need to do this, because there is probably no such thing as a “professional” that can bring me a net gain in a down market, so I shouldn’t expect any possibility of that happening.

If I believe the market will rise, and I make such an investment, then the market goes into a decline, it is actually my fault that my net investment value has deteriorated, not my advisor’s fault . . . and here’s the part that scares me . . . the “professional” whom I’ve hired believes that as well . . . and the majority of “clients” out there accept this as reality.

Is this “situation analysis” consistent with your own thinking, James?

I might have to consider an investment with you, simply because, you probably deserve it!

Many of my clients are investors who had previously placed money with market magicians who, sadly, experienced some difficulty in actually pulling the rabbit out of the hat.

it sounds like you’re saying that, as an investor, I need to decide, on my own, which way the market will be going, before I take on any kind of “investment advisor”

No! No! A thousand times, no!

It would be very nice if you could predict market direction, but I don’t think you’ll be any better at it than me, Paulson, your barber, or anybody else. It cannot be done, not on any sort of consistent basis.

You have to accept that the market might go down, due to factors that will become apparent only in hindsight.

“Ah yes”, we might say in ten years, “It was totally obvious that the current global hyperinflation first began appearing with the price of onions in India.

It is equally likely that we’ll be kicking ourselves, saying “Geez, you know … current global deflation was inevitable once the Z10 got discounted in the US.”

If you want to be a successful investor, you must accept that broad market movements are part of such a “Chaotic System” (a technical term) that they are effectively random. All you can do is:

i) Determine your portfolio objectives and

ii) Select an asset allocation that has the best probability to achieve those objectives, based on the long-term characteristics of those assets, while

iii) covering off as many of the downside risks as you can.

because there is probably no such thing as a “professional” that can bring me a net gain in a down market

Bernie Madoff was one “professional” delivering consistent results, whether the markets were up or down…

[…] PerpetualDiscounts now yield 5.34%, equivalent to 6.94% interest at the standard equivalency factor of 1.3x. Long Corporates now yield about 4.6%, so the pre-tax interest-equivalent spread is now about 235bp, a small (and perhaps spurious) narrowing from the 240bp reported July 10. […]