The Federal Reserve Bank of Boston has released a Public Policy Discussion Paper by Michelle L. Barnes, Zvi Bodie, Robert K. Triest, and J. Christina Wang titled A TIPS Scorecard: Are TIPS Accomplishing What They Were Supposed to Accomplish? Can They Be Improved?:

In September 1997, the U.S. Treasury developed the TIPS market in order to achieve three important policy objectives: (1) to provide consumers with a class of assets that allows for hedging against real interest rate risk, (2) to provide holders of nominal contracts a means of hedging against inflation risk, and (3) to provide everyone with a reliable indicator of the term structure of expected inflation. This paper evaluates progress toward the achievement of these objectives and analyzes prospective ways to better meet these objectives in the future, by, for example, extending the maturity of TIPS and/or the use of inflation indexes suited to particular geographic regions or demographics. We conclude by arguing that while it is tempting to consider completing markets by introducing more TIPS‐like securities indexed to inflation rates more tailored to particular demographics, our analysis suggests that TIPS indexed to CPI do, in fact, facilitate good synthetic hedges against unexpected changes in inflation for many different investors, since the various inflation measures are very highly correlated. We do, however, argue for extending the maturity of TIPS.

The authors do not assess the cost/benefit profile of TIPS issuance to Treasury as was discussed by, for instance, FRBNY CEO William Dudley earlier this year. The organization of the paper is:

Section II describes TIPS in more detail, emphasizing how they are designed to act as protection against changes in inflation, the tax implications for investors, the demographics of holders of TIPS, and other considerations relating to whether or not TIPS should yield measures of break‐even inflation rates comparable with survey measures of consumers’ inflation expectations or future realized rates of inflation. Section III outlines and evaluates the criticisms of the CPI and speaks to whether its potential mismeasurement is relevant to the efficacy of TIPS as a hedging instrument to guarantee the real return. It also discusses whether the CPI is a good measure for everyone, and whether there might be more appropriate measures for certain heterogeneous groups, along with the costs and benefits of issuing such securities. Section IV demonstrates the efficacy of TIPS as a hedge against various ex ante and ex post inflation measures, as well as the efficacy of TIPS as a short‐term versus a long‐term hedge. The final section concludes with implications for the design of the TIPS market.

There’s rather a neat section on inflation forecasting:

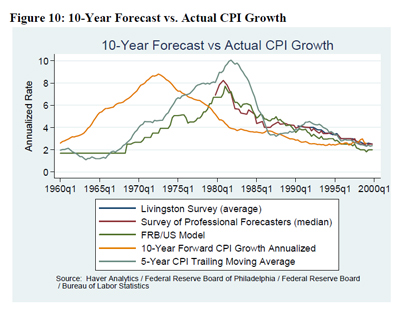

All of the expected inflation measures are largely backward‐looking, moving with recent actual rates of inflation and often deviating substantially from the actual inflation rates that would be experienced over the subsequent 10 years. This is not surprising: although there was concern about the effect of an overheated economy on short‐term inflation rates during the 1960s, it would have been essentially impossible at that time to forecast the oil shocks of the 1970s, or the response of the fiscal and monetary authorities to those shocks. Moreover, the notion of a vertical long‐run Phillips curve was still controversial among economists during the late 1960s and 1970s. Even if professional forecasters had foreseen the oil shocks and policy responses, they likely would have underestimated the extent of the resulting increase in inflation.

As a result of the unforeseen shocks, and most likely also because of errors in forecasting the response of inflation to the shocks, the actual 10‐year forward CPI growth rates were much larger than 10‐year‐forward expected inflation, starting in the mid‐1960s. Figure 11 shows the difference between the FRB/US 10‐year expected inflation variable and the actual 10‐yearforward average CPU inflation rate. Forecasts of 10‐year ahead average inflation rates increasingly underpredicted the subsequent actual experienced CPI inflation during the 1960s and early 1970s, with the underprediction of the average annual inflation rate exceeding 5 percentage points by 1972.

The authors conclude, in part:

Finally, we draw some implications for the design of the TIPS market and related financial institutions issues. We conclude that, as is, the TIPS market provides a good hedge against inflation risk and that from a cost/benefit perspective there seems little to be gained from indexing to other inflation measures—be they broader, such as the PCE deflator, or narrower, such as regional inflation measures of the CPI‐E for the elderly. A “ladder” of TIPS, with maturities linked to when money is needed for expenses, would help investors in or near retirement hedge against their nominal expenses over time. TIPS have the potential to be the backbone asset underlying inflation‐indexed annuities, but to facilitate these annuities, the maximum duration of TIPS would need to be extended. With respect to housing as an investment as opposed to a consumption good, there is room for alternative hedging instruments and they are currently available in the form of futures contracts on S&P/Case‐Shiller Metro Home Price Indexes, or forward contracts on the Residential Property Index 25‐MSA Composite (RPX).

[…] The TIPS paper has been discussed on PrefBlog. […]