OSFI has released new mortgage paperwork creation rules:

Consequently, FRFIs should maintain complete documentation of the information that led to a mortgage approval. This should generally include:

• A description of the purpose of the loan (e.g., purchase, refinancing, renovation, debt consolidation);

• Employment status and verification of income (see Principle 3);

• Debt service ratio calculations, including verification documentation for key inputs (e.g., heating, taxes, and other debt obligations);

• LTV ratio, property valuation and appraisal documentation (see Principle 4);

• Credit bureau reports and any other credit enquiries;

• Documentation verifying the source of the down payment;

Purchase and sale agreements and other collateral supporting documents;

• An explanation of any mitigating criteria or other elements (e.g., “soft” information) for higher credit risk factors;

• A clearly stated rationale for the decision (including exceptions); and

• A record from the mortgage insurer validating approval to insure the mortgage where there may be an exception to the mortgage insurer’s underwriting policies.

The above documentation should be obtained at the origination of the mortgage and for any subsequent refinancing of the mortgage. FRFIs should update the borrower analysis periodically (not necessarily at renewal) in order to effectively evaluate their credit risk. In particular, FRFIs should review some of the aforementioned factors if the borrower’s condition or property risk changes materially.

Lap-dog Carney breathlessly reports that his boss is doing a great job:

The Canadian government’s latest move to tame the mortgage market will support the “long-term stability” of the housing market and guard against the economic risks posed by excessive borrowing, Bank of Canada Governor Mark Carney said Thursday.

Speaking in Halifax just hours after Finance Minister Jim Flaherty announced a series of changes that come into effect next month, Mr. Carney reiterated his concerns about the effects that his ultra-low interest rates have had on the behaviour of both borrowers and lenders, warning the economy cannot “depend indefinitely” on debt-fuelled spending, especially as incomes stagnate.

In a free market economy, the mortgage market would be cooled off by cutting back on government guarantees of mortgage debt (CMHC guarantees have exploded over the past five years) and increasing the risk-weight assessed on the banks for mortgages (which is justifiable as the proportion of bank assets represented by mortgages is way out of whack with historical norms). But it’s more fun to micro-manage. Gets more tough-sounding headlines, too.

Fortunately, there’s some movement on the first point:

The growth of CMHC had understandably worried Canadians who were paying attention. Here was a beast that ranks among the biggest financial institutions in Canada, larger than some of our smaller banks, expanding at an astounding pace with seemingly minimal oversight from regulators and the politicians in charge.

Year by year, it would blow past its sales targets, with the amount of insurance it was writing ballooning. The insurance book at CMHC grew from $345-billion at the end of the 2007 fiscal year to $567-billion in 2011. That’s a compound annual growth rate of a little more than 13 per cent.

…

As the insurance book grew, the government steadily raised the cap on what was allowed, in what looked suspiciously like a rubber-stamp process.

…

Earlier this year, Mr. Flaherty put OSFI in an official oversight role. He signaled in an interview with The Globe and Mail that the board was likely to be upgraded to something more appropriate for a financial institution of this scale. He refused to raise the cap on insurance in force beyond the current $600-billion.Now, the move to end insurance for high-ratio mortgages on homes valued at more than $1-million and to further curtail other loans that require insurance by demanding faster paydowns will enable the CMHC to further curtail its growth.

CMHC is actually planning to allow its book to shrink in the current year, to about $557-billion, as mortgages are paid off faster (about $60-billion a year) than new insurance is originated.

But Spend-Every-Penny just can’t resist central planning:

Jim Flaherty is singling out Toronto’s overheated condo market as one of the main reasons Ottawa is tightening the rules for insured mortgages.

Hard on the heels of the BoC paper lauding repo central counterparties comes a BoC Working Paper by Hajime Tomura titled On the Existence and Fragility of Repo Markets:

This paper presents a model of an over-the-counter bond market in which bond dealers and cash investors arrange repurchase agreements (repos) endogenously. If cash investors buy bonds to store their cash, then they suffer an endogenous bond-liquidation cost because they must sell their bonds before the scheduled times of their cash payments. This cost provides incentive for both dealers and cash investors to arrange repos with endogenous margins. As part of multiple equilibria, the bond-liquidation cost also gives rise to another equilibrium in which cash investors stop transacting with dealers all at once. Credit market interventions block this equilibrium.

…

In this paper, I take as given the OTC bond market structure. Thus, a question remains regarding the optimal market design, such as whether to introduce a centralized bond market or a set-up to ensure anonymity of cash investors. Also, the empirical implications of the model are yet to be tested. One of the testable implications is that a repo margin is increasing in the difference between the interdealer bond price and the repurchase bond price. Another implication is that spot transactions in a brokered bond market increase if a repo market collapses. Addressing these issues are left for future research.

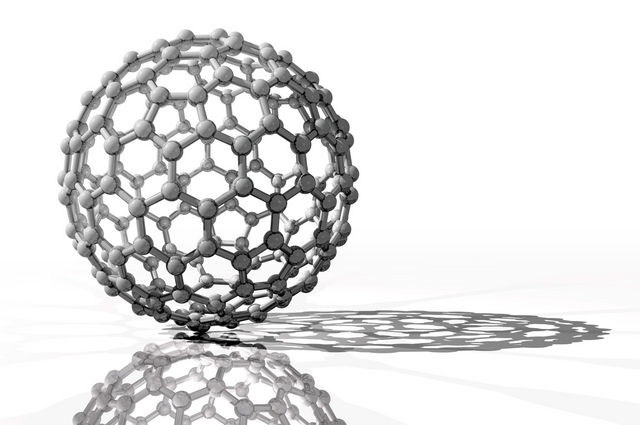

Buckyballs are undoubtedly the coolest organic molecule extant. They might even be useful!

Experimental solar cells made with two types of pure carbon absorb infrared sunlight that traditional silicon panels ignore and may eventually be used to improve efficiency, according to researchers at the Massachusetts Institute of Technology.

MIT scientists used nanotubes and spherical molecules known as buckyballs to make the first all-carbon photovoltaic cell, the Cambridge, Massachusetts-based university said today in an e-mailed statement.

Infrared light makes up about 40 percent of the solar radiation that hits the earth. Solar cells that absorb that energy may produce more electricity than conventional panels that don’t, according to Michael Strano, a professor of chemical engineering at MIT.

If we here in Ontario had any brains, we would have been pouring money into solar energy research rather than trying to create an indigenous industry with not-ready-for-prime-time technology so that we could compete with the Chinese on the basis of our lower labour costs. Unfortunately, we don’t have any brains.

Moody’s cut Royal Bank of Canada:

Moody’s Investors Service today repositioned the ratings of 15 banks and securities firms with global capital markets operations. The long-term senior debt ratings of 4 of these firms were downgraded by 1 notch, the ratings of 10 firms were downgraded by 2 notches and 1 firm was downgraded by 3 notches. In addition, for four firms, the short-term ratings of their operating companies were downgraded to Prime-2. All four of those firms also now have holding company short-term ratings at Prime-2. The holding company short-term ratings of another two firms were downgraded to Prime-2 as well.

“All of the banks affected by today’s actions have significant exposure to the volatility and risk of outsized losses inherent to capital markets activities”, says Moody’s Global Banking Managing Director Greg Bauer. “However, they also engage in other, often market leading business activities that are central to Moody’s assessment of their credit profiles. These activities can provide important ‘shock absorbers’ that mitigate the potential volatility of capital markets operations, but they also present unique risks and challenges.” The specific credit drivers for each affected firm are summarized below.

…

Royal Bank of CanadaLong-term deposit rating to Aa3 from Aa1, outlook stable; Short-term P-1 affirmed

… but it was Credit Suisse that hogged the headlines:

Credit Suisse Group AG’s credit rating was cut three levels by Moody’s Investors Service, Morgan Stanley was reduced two levels and 13 other banks were downgraded in moves that may shake up competition among Wall Street’s biggest firms.

Credit Suisse, the second-largest Swiss bank, received the maximum reduction that Moody’s said in February it may make during a review of global banks with capital markets operations. Morgan Stanley and UBS AG (UBSN), the other firms singled out for such a steep cut, were lowered two steps instead.

Capital Power L.P. is the operating subsidiary of CPX, proud issuer of CPX.PR.A:

The Company’s power generation operations and assets are owned by Capital Power L.P. (CPLP), a subsidiary of the Company. As at December 31, 2011, the Company directly and indirectly held approximately 21.750 million general partnership units and 36.924 million common limited partnership units of CPLP which represented approximately 61% of CPLP’s total partnership units. EPCOR (in this MD&A, EPCOR refers to EPCOR Utilities Inc. collectively with its subsidiaries) held 38.216 million exchangeable common limited partnership units of CPLP representing approximately 39% of CPLP. CPLP’s exchangeable common limited partnership units are exchangeable for common shares of Capital Power Corporation on a one-for-one basis. The general partner of CPLP is wholly owned by Capital Power Corporation and EPCOR’s representation on the Board of Directors does not represent a controlling vote. Accordingly, Capital Power Corporation controls CPLP and the operations of CPLP have been

consolidated for financial statement purposes.

CPLP has been confirmed by DBRS at BBB:

DBRS has today confirmed the Senior Unsecured Debt rating of Capital Power L.P. (CPLP or the Partnership) at BBB with a Stable trend. The confirmation reflects (1) the Partnership’s balanced portfolio of contracted and merchant generation with reasonable fuel-hedging positions, (2) high plant availability and (3) increased geographical and fuel diversification.

…

…credit metrics are expected to remain reasonable for the current rating category, barring material debt-funded acquisitions in the foreseeable future. However, DBRS is increasingly concerned about the continued challenging merchant power market environment that could materially add to the Partnership’s existing challenges in the medium term.

Thomson Reuters Corporation, proud issuer of TRI.PR.B, has been confirmed at Pfd-2(low) by DBRS:

Thomson Reuters undertook 39 acquisitions for a total of $1.3 billion in 2011, with approximately two-thirds of investment occurring outside the U.S. Thomson Reuters also repurchased $326 million worth of shares during the period, its first share repurchase since 2008. As such, net debt increased moderately; however, net-debt to EBITDA decreased to 1.83x at the end of 2011, from 1.91x a year earlier.

Going forward, DBRS believes Thomson Reuters’ main challenge will be to achieve revenue and margin growth through the selection and integration of strategic acquisitions. The Company’s ability to grow profitably through this strategy remains to be proven.

It was a mixed day for the Canadian preferred share market, with PerpetualPremiums winning 11bp, FixedResets up 5bp and DeemedRetractibles off 4bp. Volatility was almost non-extistent. Volume was pathetic.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0798 % | 2,314.6 |

| FixedFloater | 4.50 % | 3.87 % | 21,321 | 17.50 | 1 | -0.8920 % | 3,503.1 |

| Floater | 3.14 % | 3.14 % | 70,660 | 19.38 | 3 | -0.0798 % | 2,499.2 |

| OpRet | 4.81 % | 2.64 % | 36,469 | 1.00 | 5 | -0.0929 % | 2,507.7 |

| SplitShare | 5.25 % | -9.11 % | 44,355 | 0.50 | 4 | 0.1439 % | 2,726.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0929 % | 2,293.1 |

| Perpetual-Premium | 5.41 % | 3.46 % | 88,583 | 0.09 | 27 | 0.1051 % | 2,239.0 |

| Perpetual-Discount | 5.05 % | 5.03 % | 118,587 | 15.42 | 7 | 0.2135 % | 2,453.4 |

| FixedReset | 5.04 % | 3.11 % | 199,005 | 7.76 | 71 | 0.0512 % | 2,395.6 |

| Deemed-Retractible | 5.01 % | 3.95 % | 151,114 | 2.56 | 45 | -0.0379 % | 2,306.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.M | Perpetual-Discount | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-06-21 Maturity Price : 23.25 Evaluated at bid price : 23.61 Bid-YTW : 5.03 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.I | FixedReset | 139,420 | Desjardins crossed blocks of 95,000 and 36,100, both at 25.57. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 3.21 % |

| RY.PR.R | FixedReset | 75,720 | Nesbitt crossed 65,000 at 26.41. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.41 Bid-YTW : 3.08 % |

| BNS.PR.Z | FixedReset | 67,647 | RBC crossed 20,000 at 25.15; Desjardins crossed 30,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.06 Bid-YTW : 3.04 % |

| RY.PR.L | FixedReset | 67,520 | Nesbitt crossed 65,000 at 26.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.17 Bid-YTW : 2.99 % |

| NA.PR.K | Deemed-Retractible | 58,665 | Desjardins crossed 46,200 at 25.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-07-21 Maturity Price : 25.00 Evaluated at bid price : 25.51 Bid-YTW : -11.26 % |

| TD.PR.A | FixedReset | 52,400 | TD crossed 50,000 at 25.66. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 3.26 % |

| There were 19 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| FBS.PR.C | SplitShare | Quote: 10.80 – 11.44 Spot Rate : 0.6400 Average : 0.4131 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 23.51 – 23.93 Spot Rate : 0.4200 Average : 0.2486 YTW SCENARIO |

| BAM.PR.R | FixedReset | Quote: 25.70 – 26.19 Spot Rate : 0.4900 Average : 0.3649 YTW SCENARIO |

| NA.PR.O | FixedReset | Quote: 26.91 – 27.25 Spot Rate : 0.3400 Average : 0.2272 YTW SCENARIO |

| BAM.PR.O | OpRet | Quote: 25.61 – 26.00 Spot Rate : 0.3900 Average : 0.2894 YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 26.33 – 26.64 Spot Rate : 0.3100 Average : 0.2227 YTW SCENARIO |