Yesterday we learned that IIROC is very concerned about “layering”, a term which they did not define.

Fortunately, a real regulator commissioned a study, High frequency trading, information, and profits, by Jonathan A. Brogaard, which addresses this question:

Layering

Layering is an illegitimate strategy by which a malevolent trader places hidden orders on one side of the market, and then puts in displayed orders on the other side so as to deceive other traders into thinking that the price is moving in a given direction. Once the hidden orders have been crossed and a trade occurs, the malevolent trader withdraws his displayed orders. This is illegal and at least one firm, Trillium Trading, has been caught engaging in it (FINRA, 2010).For example, if a trader wants to buy a stock at 10.01, but its current bid is 10.02 and its ask is 10.03, it may put in a limit order to buy (a bid) at 10.01 that is hidden (or displayed). It will then place several limit orders to sell (offers) at a slightly higher price, say 10.05. Others will see that there is strong selling pressure and will subsequently adjust their bids and offers lower. Once the offer price hits 10.01 there will be a trade. The trader will have bought the stock for 10.01 and will withdraw his offer quotes.

The FINRA settlement with Trillium is in picture format, so I won’t quote from it.

What Trillium did is market manipulation, to be sure, and it deserves a fine. But it’s a bit of a stretch to paint this as the first battle in the war against high-frequency traders — not least because there isn’t actually anything particularly high-frequency about what Trillium was doing.

Yes, Finra does say that Trillium’s layering was an “improper high frequency trading strategy”. But fundamentally it was about misdirection, rather than speed.

…

But the victims are the people (or algorithms) who thought there was a naive trader posting public buy orders, and wanted to trade against that order. It’s hard to feel a lot of sympathy for them.

Frankly, I don’t feel any sympathy for them and, equally frankly, I don’t understand why layering is considered illegal. It’s misdirection, sure. So what? The layerers are putting up actionable trades that can get executed. The only people who get hurt are those who are (a) too clever by half and (b) not trading on fundamentals.

It all gets back to my insistence that anything that doesn’t necessarily hurt a fundamental trader should almost always be perfectly legal. Let us say, for instance, that I want to buy 10,000 shares of ABC.PR.A at 25.05 but the market’s really thin: 25.00-10, with not much size on the 25.10 offer and not much behind it.

Some might say I should put in a bid for 10,000 at 25.05, since that’s what I want to do, but we can disregard that advice. I’m not going to write a put option for 10,00 shares mid-market for free! No, I might bid 1,000 at 25.01. Maybe 25.00. Who knows, maybe even only 24.95, outside the market, if there isn’t much of a bid. I mean, hell, if I’m the only one willing to supply liquidity, why shouldn’t I get paid for it?

So along comes the the horrible, horrible layering guy. He wants to buy at 25.00. So he puts in an offer for 10,000 shares at 25.05 to drive the price down. So I lift his offer (maybe with a pounce algorithm, if I happen to be using such a a facility) – thank you very much! I’ve got my trade done and, to the extent that I am an “informed trader”, I’m probably going to make some money and he’s probably going to lose some.

Why does IIROC have such a prejudice against informed traders? Why is IIROC so eager to protect speculative cowboys at the expense of fundamental traders?

To be fair, there are opposing views:

Say a stock is trading at $25/share. Looking at the Level II ladder, on the buy side you can see many shares at $25, $24.99, $24.98, $24.97, $24.96, waiting to execute. As a daytrader, you make an offer to buy at say $25.97, believing that there really are buyers at these levels and that the market is currently heavily traded. Your trade is filled but just as that happens, you see the offers to buy literally evaporate. These were phony to begin with, and in truth, the security was really thinly traded, not heavily traded at all. Now you have difficulty exiting your trade and you end up taking a loss.

But look at that … “in truth, the security was really thinly traded”. Well, if you don’t know anything about the stock you’re trading other than a one-time snapshot of the market, I suggest you should get burnt. Note the author’s profession:

Barbara Cohen CIO, Shadowtraders, and professional day trader, specializes in teaching students how they can be trading futures with their own trading system and trading strategies.

It would seem that at least a partial explanation for her opposition is that the HFT guys are simply better at the job than are her students.

And look what passes for brilliant innovation among the old-money crowd! As mentioned on 2012-2-8, RBC received a good dose of breathless adoration for it’s THOR execution product. And what does THOR do, one might ask? According to the product sheet:

Latency normalization is an important factor in securing liquidity and obtaining best execution.

• THOR’s synchronization logic compensates for timing differentials across North America, minimizing cancellation windows for high-frequency trading algorithms; this significantly reduces information leakage, leading to higher fill rates.

So the programme staggers the sending times to minimize the difference in the exchange’s receiving times, thereby minimizing the window in which the Evil HFT Layerer can cancel his misdirecting order. May I be excused for thinking that this idea is a teensy-weeny little bit obvious? As well as resulting from a simple reverse-engineering investigation, rather than breaking new ground?

The LIBOR hand-wringing is heating up again:

The conspiracy wasn’t confined to low-level employees. Senior managers at RBS, Britain’s largest publicly owned lender, knew banks were systematically rigging Libor as early as August 2007, transcripts of phone conversations obtained by Bloomberg show. Some traders colluded with counterparts at other banks to boost profits from interest-rate futures by aligning their submissions. Members of the close-knit group knew each other from working at the same firms or going on trips organized by interdealer brokers such as ICAP Plc (IAP) to Chamonix, a French ski resort, or the Monaco Grand Prix.

…

Regulators have known since at least August 2007 that banks were using artificially low Libor submissions to appear healthier than they were. That month, a Barclays employee in London e-mailed the Federal Reserve Bank of New York, questioning the numbers that other banks were inputting, according to transcripts published by the New York Fed.Nine months later, Tim Bond, then head of asset allocation at Barclays’s investment bank, publicly described the Libor figures as “divorced from reality,” saying in a Bloomberg Television interview that firms were routinely misstating their borrowing costs to avoid the perception they were facing stress.

The New York Fed and the Bank of England say they didn’t act because they had no responsibility for oversight of Libor. That fell to the British Bankers’ Association, the industry lobbying group that created the rate and largely ignored recommendations from central bankers after 2008 to change the way the benchmark is computed. Regulators also were preoccupied with the biggest financial crisis since the Great Depression, and forcing banks to be honest about their Libor submissions might have revealed they were paying penalty rates to borrow.

Here’s deposit insurance with a vengeance:

The European Commission plans to propose the bank resolution mechanism in 2013, EU leaders said in a statement after the meeting.

The resolution mechanism “will be based on contributions by the financial sector” and will contain backstops that will “be fiscally neutral over the medium term, by ensuring that public assistance is recouped by means of ex-post levies on the financial industry,” the leaders said in the statement.

Penalizing good banks for the sins of bad banks and their lackadaisical regulators? How can this possibly be justified? And why isn’t 500 years of bankruptcy law good enough? I’m still waiting for an answer to that last one.

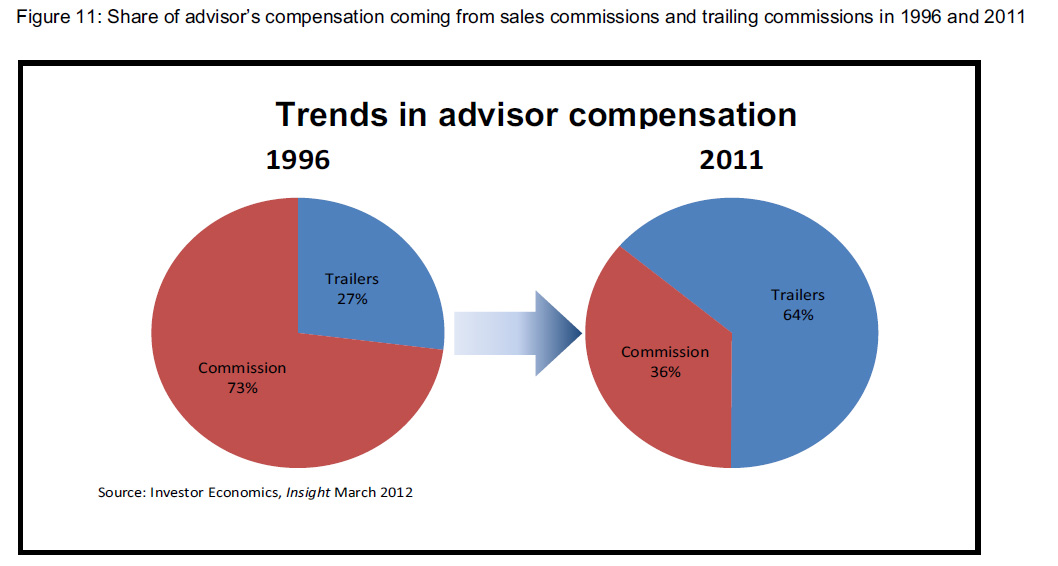

As part of the continuing effort to ensure that the experience and wisdom of Canadian regulators is properly venerated and applied to the questions of the day, the CSA has released DISCUSSION PAPER AND REQUEST FOR COMMENT 81-407: MUTUAL FUND FEES. I was most interested in Figure 11.

At present, mutual fund manufacturers may fund increased trailing commissions to advisors by simply allocating a greater portion of the management fees they earn to the payment of these commissions. While overall fund costs do not increase in this scenario, investors have no say in the extent to which their mutual fund assets are used to pay for advisor compensation.

Oh, the horror! Imagine that! Mutual Funds are just like every single other product sold to retail, including vegetables and beer!

Using fund assets to pay for trailing commissions could encourage additional sales of the fund. This could increase the fund’s assets under management, which would increase the management fees payable. This creates an actual or a perceived conflict of interest between the mutual fund manufacturer and the fund’s investors.83 This practice could put the mutual fund manufacturer at odds with its statutory duty to act in the best interest of the mutual fund84 to the extent the mutual fund manufacturer, rather than the fund and its investors, is the primary beneficiary of the fund’s asset growth. The mutual fund manufacturer must be able to demonstrate that it is acting in the best interests of the mutual fund and its investors, and not itself, when engaging in this practice.85

I find this rather breathtaking; not just in the bland assertion that charging for services rendered “could” be a conflict of interest, but in the implication of the last sentence, in which the manufacturers are obliged to prove they are not crooks.

So now we get to the grand finale:

Some possible changes include:

i. Advisor services to be specified and provided in exchange for trailing commissions …

ii. A standard class for DIY investors with no or reduced trailing commission

Every mutual fund could have a low-cost ‘execution-only’ series or class of securities available for direct purchase by investors. The lower management fees of this series or class would reflect that no or nominal trailing commissions are paid to advisors, in light of the lack of advice sought by DIY investors who purchase and hold securities of this series or class. This low-cost series or class of securities could be made available to investors through a discount brokerage, or alternatively, be distributed directly by the mutual fund manufacturer, in which case the mutual fund manufacturer would need to be registered as a mutual fund dealer.

iii. Trailing commission component of management fees to be unbundled and charged/disclosed as a separate assetbased fee…

iv. A separate series or class of funds for each purchase option …

v. Cap commissions There could be a maximum limit set on the portion of mutual fund assets that could be used to pay trailing commissions to advisors as a way to mitigate the perceived conflicts of interests and the lack of alignment of advisor compensation and services described in Part V. This could be achieved by imposing a cap on the separate asset-based fee discussed in option iii above. Trailing commissions could further be plainly labelled or described as “ongoing sales commissions” in mutual fund disclosure documents, thus providing greater transparency for investors of their main purpose.In addition or as an alternative to a cap on trailing commissions at the mutual fund level, there could be a cap imposed on the aggregate sales charge, that is, the sum of any initial sales charge and “ongoing sales commission” that could be paid by an individual investor at the account level over the length of a mutual fund investment. Once the cap is reached, the investor’s holdings could be automatically converted to a series or class of securities of the mutual fund not bearing an ongoing assetbased sales charge. This would bring certainty to an investor as to the maximum sales commission payable.

The U.S. imposes caps on commissions paid by mutual fund investors. These caps are imposed through a prohibition on advisors who are members of FINRA from offering or selling shares of any investment company if the sales charges described in the prospectus are excessive. “Excessive” is determined by reference to specific sales charge limits prescribed under FINRA’s business conduct rules.157 Those same rules similarly impose limits on trailing commission rates for both load158 and no-load investment companies.159

vi. Implement additional standards or duties for advisors…

vii. Discontinue the practice of advisor compensation being set by mutual fund manufacturers…

With respect to (ii), it’s not clear how the discount brokerages will get paid. Earth to CSA: no pay, no work. It’s also not clear just what the manufacturor’s responsibilities will be in the event they are registered to sell securities direct. I suspect it means lots and lots of jobs for ex-regulators.

With respect to (v), it’s just plain none of the regulators’ damn business.

I think all the specified regulatory make-work projects are completely nuts myself, but I am well aware that others will differ. Those others may wish to know:

VIII. COMMENT PROCESS

We welcome feedback on the issues raised and the potential regulatory options discussed in this paper. We invite all interested parties to make written submissions. Submissions received by April 12, 2013 will be considered.

DBRS confirmed BAM Split at Pfd-2(low) (proud issuer of BNA.PR.B, BNA.PR.C, BNA.PR.D and BNA.PR.E):

The Pfd-2 (low) ratings of the Class AA Preferred Shares are primarily based on the downside protection and dividend coverage available to the Class AA Preferred Shares.

The main constraints to the ratings are the following:

(1) The downside protection available to holders of the Class AA Preferred Shares depends solely on the market value of the BAM Shares held in the Portfolio, which will fluctuate over time.

(2) There is a lack of diversification as the Portfolio is entirely made up of BAM Shares.

(3) Changes in the dividend policy of BAM may result in reductions in Class AA Preferred Shares dividend coverage.

(4) As the BAM Shares pay dividends in U.S. dollars, the Company is exposed to foreign currency risk relating to the Canadian-U.S. exchange rate, specifically the appreciation of the Canadian dollar vs. the U.S. dollar. This may have a negative impact on the dividend coverage ratio of the Class AA Preferred Shares as these dividends are paid in Canadian dollars.

(5) Downside protection available to the Class AA Preferred Shares may be negatively affected by the retraction of the Junior Preferred Shares.

Oddly, there was no mention of the credit quality of BAM itself in the DBRS press release. According to the DBRS SplitShare methodology:

The importance of credit quality in a portfolio increases as the diversifi cation of the portfolio decreases. To be included as a single name in a split share portfolio, a company should be diversified in its business operations by product and by geography. The rating on preferred shares with exposure to single-name portfolios will generally not exceed the rating on the preferred shares of the underlying company since the downside protection is dependent entirely on the value of the common shares of that company.

S&P dropped a bomb on bank preferreds:

- •We believe that the Canadian banking sector is encountering incremental pressure from headwinds facing the Canadian economy, which is heightening economic risk in the banking system. We also believe that industry risk for the Canadian banking sector is increasing. We expect that intensifying competition for loans and deposits will lead to pressure on profitability growth, especially in banks’ retail businesses.

- •We are therefore lowering our issuer credit ratings by one notch on The Bank of Nova Scotia, Central 1 Credit Union, Caisse centrale Desjardins, Home Capital Group Inc., Laurentian Bank of Canada, and National Bank of Canada. The outlook is stable.

- •We are affirming our issuer credit ratings and stable outlooks on Bank of Montreal (and BMO Financial), Canadian Imperial Bank of Commerce, and Manulife Bank of Canada. We have lowered the related stand-alone credit profiles (SACPs) for these institutions by one notch, however.

- •We are also affirming our issuer credit ratings on Royal Bank of Canada and The Toronto-Dominion Bank, and revising the respective outlooks to stable from negative.

- •We are also affirming our issuer credit rating with a negative outlook on HSBC Bank Canada, which reflect those on its parent.

- HSB preferreds were unaffected, but the outlook remained negative, where it was set last August.

- TD was affirmed, Outlook revised to Stable

- RY was affirmed, Outlook revised to Stable

- BMO was downgraded to P-2, Outlook Stable

- BNS was downgraded to P-2(high), Outlook now stable

- LB was downgraded to P-3(high), Outlook now Stable

- NA was downgraded to P-2, Outlook now Stable

- CM was downgraded, the NVCC issues to P-2(low), non-NVCC issues to P-2

It was a strikingly mixed day for the Canadian preferred share market, with PerpetualPremiums up 10bp, FixedResets off 5bp and DeemedRetractibles gaining 15bp. Volatility was low. Volume was high and the highlights are exclusively FixedResets.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1837 % | 2,473.5 |

| FixedFloater | 4.12 % | 3.48 % | 30,010 | 18.32 | 1 | -0.3459 % | 3,904.1 |

| Floater | 2.81 % | 3.00 % | 61,994 | 19.73 | 4 | -0.1837 % | 2,670.7 |

| OpRet | 4.64 % | 2.00 % | 51,684 | 0.51 | 4 | -0.3336 % | 2,591.1 |

| SplitShare | 4.65 % | 4.72 % | 61,904 | 4.41 | 2 | 0.0809 % | 2,866.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3336 % | 2,369.3 |

| Perpetual-Premium | 5.25 % | 1.70 % | 72,110 | 0.20 | 30 | 0.0994 % | 2,322.5 |

| Perpetual-Discount | 4.86 % | 4.86 % | 133,287 | 15.63 | 4 | 0.1222 % | 2,634.6 |

| FixedReset | 4.94 % | 3.02 % | 233,276 | 4.33 | 77 | -0.0460 % | 2,448.8 |

| Deemed-Retractible | 4.91 % | 2.25 % | 115,789 | 0.44 | 46 | 0.1550 % | 2,410.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TD.PR.E | FixedReset | -4.17 % | Not real – the market maker just fell asleep, that’s all. The issue traded 5,850 shares in a range of 26.45-60, so this is just another example of inexcusable sloppiness. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.51 Bid-YTW : 5.28 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.F | FixedReset | 158,700 | Desjardins crossed 150,000 at 26.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.36 Bid-YTW : 2.22 % |

| HSB.PR.E | FixedReset | 152,025 | RBC crossed 145,000 at 26.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.55 Bid-YTW : 2.30 % |

| ENB.PR.T | FixedReset | 118,825 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-12-13 Maturity Price : 23.10 Evaluated at bid price : 25.02 Bid-YTW : 3.70 % |

| BAM.PR.P | FixedReset | 94,176 | Nesbitt crossed 50,000 at 26.80; TD crossed 24,200 at the same price; Desjardins crossed 12,000 at the same price again. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-30 Maturity Price : 25.00 Evaluated at bid price : 26.70 Bid-YTW : 2.92 % |

| BNS.PR.Q | FixedReset | 75,131 | Nesbitt crossed 48,300 at 24.80. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.86 Bid-YTW : 3.32 % |

| CIU.PR.C | FixedReset | 73,800 | Nesbit sold 15,000 to Desjardins at 24.81, crossed 36,400 at 24.84, and sold 10,000 to RBC at 24.84. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-12-13 Maturity Price : 23.24 Evaluated at bid price : 24.80 Bid-YTW : 2.69 % |

| There were 40 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| TD.PR.E | FixedReset | Quote: 25.51 – 26.55 Spot Rate : 1.0400 Average : 0.5817 YTW SCENARIO |

| BAM.PR.C | Floater | Quote: 17.44 – 17.99 Spot Rate : 0.5500 Average : 0.3545 YTW SCENARIO |

| MFC.PR.A | OpRet | Quote: 25.75 – 26.23 Spot Rate : 0.4800 Average : 0.2970 YTW SCENARIO |

| BAM.PR.P | FixedReset | Quote: 26.70 – 27.10 Spot Rate : 0.4000 Average : 0.2652 YTW SCENARIO |

| IGM.PR.B | Perpetual-Premium | Quote: 26.38 – 26.69 Spot Rate : 0.3100 Average : 0.1946 YTW SCENARIO |

| TD.PR.G | FixedReset | Quote: 26.41 – 26.64 Spot Rate : 0.2300 Average : 0.1300 YTW SCENARIO |

Mutual Funds

Given that the same information (ie: MER’s, embedded trailers) has been published a gazillion times in the business press, there simply is no excuse for the so-called ‘investor’ to not understand the process. Old news.

Quite simply, how can you blame an industry (which includes the banks, and their other questionable product shams like PPN’s) that quietly understands the basic premise for their success: consumer ignorance is highly profitable.

Well said.

[…] a “real” move – the market maker simply woke up after yesterday’s nap. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-30 Maturity Price : 25.00 […]

[…] mentioned the regulatory proposals on trailer fees on December 13 and will have more to say – in response to a query from an Assiduous Reader – shortly. […]

[…] mentioned yesterday, I received a query from an Assiduous Reader asking me to clarify my remarks of December 13 regarding the recent CSA Discussion Paper and Request for Comments on Mutual Fund […]