ROC Pref Corp II has announced:

that Standard & Poor’s (“S&P”) lowered its ratings on ROC II’s Preferred Shares from P-1 (low) to P-2 and the Preferred Shares remain on CreditWatch withnegative implications. S&P expects to resolve the CreditWatch placement within a period of 90 days and update its opinion. As announced in a press release dated September 25, the move comes as a result of the Lehman Brothers HoldingsInc. credit event as well as several downgrades of companies held in the Reference Portfolio.

ROC Pref II Corp.’s Preferred Shares pay a fixed quarterly coupon of 4.65% on their $25.00 principal value and will mature on December 31, 2008. The Standard & Poor’s rating addresses the likelihood of full payment of distributions and payment of $25.00 principal value per Preferred Share on the maturity date.

There’s an error in the release – the actual maturity date of the prefs is Dec. 31 2009, according to the prospectus, which makes the 90 day delay until resolution of the Credit Watch Negative much less amusing.

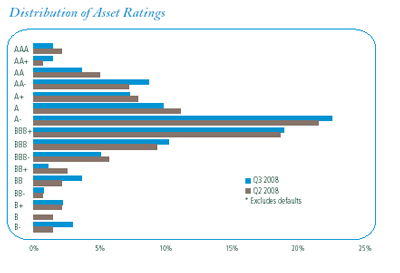

According to the 3Q08 Performance Report, the credit distribution is:

and

The subordination provides protection of approximately 5.5 defaults net of the estimated recovery rate of 40%, which is 6.6 times the average and 3.0 times the worst cumulative historical default level for a portfolio with the same credit ratings distribution over rolling 1.25-year periods (being equal to the remaining life of ROC II) during the 25-year period ending 20071. Although the trading reserve account has increased since inception, the rising cost of subordination (default protection or “safety cushion”) has reduced HSBC’s (the issuer of the credit linked note) estimate of the amount of additional protection that can be purchased in the event that CC&L decides to use the trading reserve account to purchase additional subordination by approximately 0.3 defaults. Inclusive of the trading reserve account, the additional number of defaults that ROC II can withstand declined by approximately 2.0 defaults during the quarter to 5.5 defaults.

RPA.PR.A was last discussed on PrefBlog when the effects of the Lehman bankruptcy were announced.

RPA.PR.A is not tracked by HIMIPref™.

[…] RPA.PR.A was last mentioned on PrefBlog when S&P downgraded it to P-2. […]