There is a report that the London Office of AIG’s now notorious Financial Products Group took on notional exposure of USD 500-billion in sub-prime CDSs … not bad leverage for one office of one division, considering AIG’s total equity was $104-billion in June 07, just before the fun started.

Econbrowser‘s James Hamilton advocates having AIG default on its CDSs:

But the issue for me has always been not to exact retribution or instill market discipline, but instead the very pragmatic question of how to use available resources to minimize collateral damage. I accept the argument that a complete failure of AIG would have unacceptable consequences. The relevant question then is, what combination of parties is going to absorb the loss?

The concern I wish to raise is that any reasonable answer to that question would include Goldman Sachs, Merrill Lynch, Societe Generale, and Calyon, to pick a few names at random, as major contributors to this particular collateral-damage-minimization relief fund.

…

Then there’s the domino effect to consider. What do we do when this brings down the next player who can’t continue operations without those payments AIG (or the taxpayers) were supposedly going to deliver? I say, we implement the parallel operation there.

I can’t agree. This would have knock-on effects akin to another Lehman; the cure would be worse than the disease. The policy focus should not be on minimizing cost, but on minimizing harm.

I certainly agree that it is unfortunated that taxpayers are getting hurt and it is clear that regulation must be improved. However, pain is part of the game. Western economies in general and Amercian taxpayers in particular have been well served by the financial system.

Who wants to live in a country without a functional banking system, particularly the mortgage market? I don’t know what the system is like now, but I understand the Indian mortgage market was basically non-existent not too many years ago. So the middle class had to save all their lives to buy a place and maybe be able to look around by the time they were 55. Housing 55! There’s a good insurance slogan!

However, the drumbeat of retribution continues:

Debt investors are an attractive target because of the size of their holdings — more than $1 trillion just at the four largest U.S. banks — and because they’ve emerged almost unscathed so far. Since any reduction in debt at a bank helps boost capital ratios, members of Congress including U.S. Representative Brad Sherman, a California Democrat, say it’s time for bondholders to share the pain.

“These banks can go into receivership, shed their shareholders, shed or reduce the amount they owe to their bondholders and come back out much stronger institutions,” said Sherman, who sits on the House Financial Services Committee, in a statement to Bloomberg News. More U.S. capital might be offered as part of the package, he said.

Go for it, Sherman. Regardless of the situation a year ago, these institutions now have TARP money and bond-holders are senior to TARP money. You might find yourself on the wrong end of a cramdown.

With this kind of talk floating around, is it any wonder the US Corporate market is dysfunctional?:

I think the corporate bond market is still fractured. It is not as dysfunctional as it was in October and November but the realization that solid well established companies need to provide as much of a concession as these entities are here is a sign that there is a very long road to travel before the corporate bond market functions with a degree of normality.

Meanwhile, the GSEs are a continuing disaster:

Freddie Mac, the mortgage-finance company thrust into a leading role in President Barack Obama’s homeowner rescue plans, said it will tap $30.8 billion in federal aid as its loan holdings and other assets deteriorated.

The company, which owns or guarantees more than 20 percent of U.S. home loans, today posted a wider fourth-quarter net loss of $23.9 billion, or $7.37 a share. The results pushed the value of Freddie’s assets below its liabilities, the McLean, Virginia- based company said in a statement, and come as Chief Executive Officer David Moffett leaves after six months on the job.

…

Freddie and larger competitor Fannie Mae have been pressured to carry out policy initiatives, including offering low-cost mortgage refinancings, since the government takeover. The often conflicting demands of appeasing regulators and pursuing profit may have led Moffett to resign, [F&R Capital Markets analyst Paul] Miller said.“They want these guys to refi mortgages without new appraisals and to keep mortgage rates very low; those are not sound business decisions,” Miller said. “They are being used as a public policy tool to save the housing market. That is just going to make it more difficult for them to be floated out as public companies down the road.”

In what is almost certainly an orchestrated move, Bernanke’s proposed Financial Stability Regulator has attracted support:

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said the U.S. needs a “systemic risk regulator” and should set up procedures to deal with potential failures of large financial institutions.

“Failure is fine as long as it’s orderly, controlled, leads to resolution and doesn’t cause systemic failure,” Dimon, 52, said at a conference hosted by the U.S. Chamber of Commerce in Washington.

Dimon said at a Feb. 3 conference that he believed the Federal Reserve should have the authority to regulate all companies within the banking system.

CDS junkies, by the way, may wish to read the Observations on Management of Recent Credit Default Swap Credit Events.

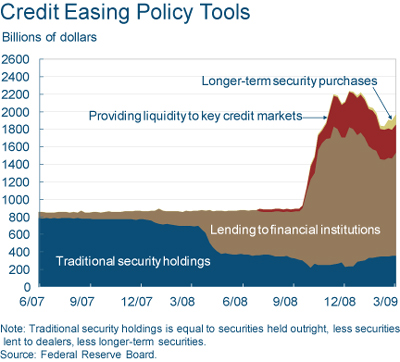

The Cleveland Fed has released its March Econotrends, with an interesting chart-pack on the impact of credit easing so far. The Fed’s balance sheet has begun to bloat again:

Annoyed at having been called insane, PerpetualDiscounts rose 90bp to yield 7.52%, equivalent to 10.53% interest at the standard equivalency factor of 1.4x. Long Corporates now yield 7.6%, so the pre-tax interest-equivalent spread is now about 290bp … certainly at the high end of its range, although nowhere near the November end-of-the-world levels.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.3141 % | 783.1 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.3141 % | 1,266.5 |

| Floater | 5.05 % | 5.96 % | 62,739 | 14.00 | 3 | 1.3141 % | 978.4 |

| OpRet | 5.34 % | 5.12 % | 138,130 | 3.91 | 15 | 0.1546 % | 2,028.8 |

| SplitShare | 7.11 % | 10.48 % | 54,848 | 4.79 | 6 | 0.3421 % | 1,560.5 |

| Interest-Bearing | 6.28 % | 13.25 % | 37,376 | 0.76 | 1 | -1.0352 % | 1,870.9 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.9033 % | 1,434.2 |

| Perpetual-Discount | 7.53 % | 7.52 % | 164,704 | 11.92 | 71 | 0.9033 % | 1,320.8 |

| FixedReset | 6.27 % | 5.90 % | 683,625 | 13.67 | 31 | -0.0028 % | 1,764.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| NA.PR.N | FixedReset | -2.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 22.06 Evaluated at bid price : 22.12 Bid-YTW : 4.70 % |

| BAM.PR.O | OpRet | -2.11 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 20.00 Bid-YTW : 10.93 % |

| RY.PR.E | Perpetual-Discount | -1.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.82 Evaluated at bid price : 15.82 Bid-YTW : 7.20 % |

| CIU.PR.A | Perpetual-Discount | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 16.26 Evaluated at bid price : 16.26 Bid-YTW : 7.15 % |

| BMO.PR.L | Perpetual-Discount | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 19.32 Evaluated at bid price : 19.32 Bid-YTW : 7.60 % |

| DFN.PR.A | SplitShare | -1.38 % | Asset coverage of 1.5-:1 as of February 27 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.84 Bid-YTW : 10.48 % |

| ACO.PR.A | OpRet | -1.35 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2011-11-30 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 4.89 % |

| CM.PR.M | FixedReset | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 22.94 Evaluated at bid price : 24.45 Bid-YTW : 6.29 % |

| PWF.PR.F | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 16.10 Evaluated at bid price : 16.10 Bid-YTW : 8.32 % |

| BNS.PR.K | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 7.06 % |

| SBN.PR.A | SplitShare | -1.06 % | Asset coverage of 1.5-:1 as of March 5 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.42 Bid-YTW : 8.97 % |

| STW.PR.A | Interest-Bearing | -1.04 % | Asset coverage of 1.4+:1 as of March 5, based on Capital Unit NAV of 2.02. and 1.99 Capital Units per Preferred. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2009-12-31 Maturity Price : 10.00 Evaluated at bid price : 9.56 Bid-YTW : 13.25 % |

| CM.PR.E | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 17.76 Evaluated at bid price : 17.76 Bid-YTW : 8.04 % |

| GWO.PR.E | OpRet | 1.03 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2014-03-30 Maturity Price : 25.00 Evaluated at bid price : 24.50 Bid-YTW : 5.12 % |

| IGM.PR.A | OpRet | 1.03 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-06-29 Maturity Price : 25.00 Evaluated at bid price : 25.41 Bid-YTW : 5.27 % |

| TD.PR.C | FixedReset | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 23.26 Evaluated at bid price : 23.30 Bid-YTW : 5.16 % |

| PWF.PR.G | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 8.27 % |

| POW.PR.A | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 17.75 Evaluated at bid price : 17.75 Bid-YTW : 8.07 % |

| TD.PR.R | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 19.99 Evaluated at bid price : 19.99 Bid-YTW : 7.13 % |

| BNS.PR.M | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 16.10 Evaluated at bid price : 16.10 Bid-YTW : 7.11 % |

| BNS.PR.O | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 20.05 Evaluated at bid price : 20.05 Bid-YTW : 7.11 % |

| CM.PR.I | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.00 Evaluated at bid price : 15.00 Bid-YTW : 7.99 % |

| BNS.PR.N | Perpetual-Discount | 1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.51 Evaluated at bid price : 18.51 Bid-YTW : 7.22 % |

| MFC.PR.B | Perpetual-Discount | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 14.50 Evaluated at bid price : 14.50 Bid-YTW : 8.08 % |

| RY.PR.H | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 20.80 Evaluated at bid price : 20.80 Bid-YTW : 6.88 % |

| SLF.PR.A | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 13.39 Evaluated at bid price : 13.39 Bid-YTW : 8.92 % |

| RY.PR.L | FixedReset | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 23.20 Evaluated at bid price : 23.24 Bid-YTW : 5.09 % |

| CM.PR.J | Perpetual-Discount | 1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 14.57 Evaluated at bid price : 14.57 Bid-YTW : 7.88 % |

| PWF.PR.E | Perpetual-Discount | 1.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 17.00 Evaluated at bid price : 17.00 Bid-YTW : 8.25 % |

| CM.PR.D | Perpetual-Discount | 1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.47 Evaluated at bid price : 18.47 Bid-YTW : 7.94 % |

| SLF.PR.D | Perpetual-Discount | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 12.85 Evaluated at bid price : 12.85 Bid-YTW : 8.70 % |

| TD.PR.P | Perpetual-Discount | 1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.46 Evaluated at bid price : 18.46 Bid-YTW : 7.24 % |

| CM.PR.K | FixedReset | 1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 21.52 Evaluated at bid price : 21.85 Bid-YTW : 4.99 % |

| CU.PR.A | Perpetual-Discount | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 21.35 Evaluated at bid price : 21.35 Bid-YTW : 6.86 % |

| BNS.PR.L | Perpetual-Discount | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 16.41 Evaluated at bid price : 16.41 Bid-YTW : 6.98 % |

| CM.PR.P | Perpetual-Discount | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 17.61 Evaluated at bid price : 17.61 Bid-YTW : 7.97 % |

| BAM.PR.M | Perpetual-Discount | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 12.20 Evaluated at bid price : 12.20 Bid-YTW : 9.79 % |

| BAM.PR.N | Perpetual-Discount | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 12.18 Evaluated at bid price : 12.18 Bid-YTW : 9.81 % |

| ENB.PR.A | Perpetual-Discount | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 22.71 Evaluated at bid price : 23.00 Bid-YTW : 6.02 % |

| CM.PR.H | Perpetual-Discount | 1.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.28 Evaluated at bid price : 15.28 Bid-YTW : 8.01 % |

| BAM.PR.J | OpRet | 1.87 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.51 Bid-YTW : 10.66 % |

| ELF.PR.G | Perpetual-Discount | 1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 13.30 Evaluated at bid price : 13.30 Bid-YTW : 9.16 % |

| SLF.PR.E | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 13.16 Evaluated at bid price : 13.16 Bid-YTW : 8.59 % |

| GWO.PR.G | Perpetual-Discount | 2.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.40 Evaluated at bid price : 15.40 Bid-YTW : 8.49 % |

| PWF.PR.A | Floater | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 11.45 Evaluated at bid price : 11.45 Bid-YTW : 3.85 % |

| HSB.PR.D | Perpetual-Discount | 2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 7.47 % |

| NA.PR.K | Perpetual-Discount | 2.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 20.15 Evaluated at bid price : 20.15 Bid-YTW : 7.37 % |

| POW.PR.D | Perpetual-Discount | 2.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.62 Evaluated at bid price : 15.62 Bid-YTW : 8.19 % |

| TD.PR.Q | Perpetual-Discount | 2.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 7.05 % |

| GWO.PR.I | Perpetual-Discount | 2.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 14.10 Evaluated at bid price : 14.10 Bid-YTW : 8.02 % |

| PWF.PR.K | Perpetual-Discount | 2.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 14.90 Evaluated at bid price : 14.90 Bid-YTW : 8.48 % |

| BMO.PR.H | Perpetual-Discount | 3.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 19.06 Evaluated at bid price : 19.06 Bid-YTW : 7.04 % |

| POW.PR.C | Perpetual-Discount | 3.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.73 Evaluated at bid price : 18.73 Bid-YTW : 7.92 % |

| PWF.PR.L | Perpetual-Discount | 3.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 15.31 Evaluated at bid price : 15.31 Bid-YTW : 8.50 % |

| BNS.PR.S | FixedReset | 4.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 23.46 Evaluated at bid price : 26.00 Bid-YTW : 5.50 % |

| PWF.PR.H | Perpetual-Discount | 4.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 8.08 % |

| BNA.PR.B | SplitShare | 4.53 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2016-03-25 Maturity Price : 25.00 Evaluated at bid price : 21.01 Bid-YTW : 8.02 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.P | Perpetual-Discount | 124,400 | Scotia crossed 21,300 at 18.50, then another 95,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 18.46 Evaluated at bid price : 18.46 Bid-YTW : 7.24 % |

| RY.PR.T | FixedReset | 83,101 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 23.07 Evaluated at bid price : 24.83 Bid-YTW : 5.90 % |

| TD.PR.I | FixedReset | 80,955 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 23.09 Evaluated at bid price : 24.88 Bid-YTW : 5.96 % |

| CM.PR.L | FixedReset | 55,289 | National bought 13,800 from TD at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 24.78 Evaluated at bid price : 24.83 Bid-YTW : 6.40 % |

| BNS.PR.X | FixedReset | 48,297 | Scotia bought 25,000 from HSBC at 25.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 25.16 Evaluated at bid price : 25.21 Bid-YTW : 6.22 % |

| CM.PR.M | FixedReset | 44,785 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-11 Maturity Price : 22.94 Evaluated at bid price : 24.45 Bid-YTW : 6.29 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. | |||

Re: AIG default on $500B of CDS.

I gather from Wikipedia’s CDS page that despite $400B of Lehman CDS which might have required 91 cents on the dollar ($360B notional to close), the net exposures were only 2% of that or $7B changed hands.

Is it correct to then estimate that 2% of AIGs $500B = $10B might be the net exposure if AG defaults on CDS? (which might be why Hamilton is OK with letting them default) Or because AIG is the CDS writer, the losses elsewhere are different — e.g. the amounts paid to AIG so far, which might be $10-30B.

Also, would a default on CDS written be equivalent to a bond default by AIG? Thereby triggering other CDS payouts on AIG-referenced CDS (Lehman all over again).

Even if NET payments are low, might they be unevenly distributed, threatening some institutions while providing windfalls to others? Since noboby would be sure, that might be bad for confidence as a whole.

It seems to me that CDS writing is insurance. If the insurance company defaults on coverage, no more premiums are paid and the purchasers have to get protection elsewhere or go back to being unhedged. I guess there would be lawsuits for “lost value”, too, if permitted by the CDS terms. The US government may not want to be in an insurance business with huge potential losses, so may feel no compunction to honor AIG written CDS with public money. If the government does nothing, it is supporting the CDS market with its giant derivative tail wagging the smaller economic dog. If it tries to get out the the business and this causes the CDS market to collapse, maybe it takes the banks with it. Seems like d***ed if you do, d***ed if you don’t.

I am wondering if CDS as a source of magnified leverage may be what the Fed is most worried about, but they can hardly say so without triggering a panic. If it is a source of concern, I don’t see a lot happening to reduce exposure at the banks.

I’m wondering if AIGs CDS counterparties (long the protection) stand before or after capital holders (common, pref, sub debt, and debt).

Wiki-what? Don’t bother with the fifteen-year-olds, man! The Lehman settlement is discussed in the link provided above for CDS junkies.

The difference between net and gross settlements is due to hedging. If I buy protection from you at 300 bp, then sell it back a month later for 400bp, this is not normally done by repricing and closing the first contract; instead, we’d have two contracts outstanding, with me receiving a net 100bp from you until expiration of the first contract, then receiving 400bp until expiration of the second.

People get flabbergasted by the idea that JPM had $94-trillion notional contracts on the books, but it was all offsetting (mostly, I’ll bet, with identical counterparties). Scotia’s 1Q09 Report was a good example of this:

But my understanding is that AIG was not a trader, with lots of its gross exposure netting out – their net exposure is very close to their gross.

It seems to me that CDS writing is insurance.

Well, I know that New York State agrees with you, although I’m not convinced I do. Writing a cash-covered CDS is, to a first approximation, equivalent to owning a cash bond, which is why you can talk about the basis, and basis risk, without being laughed out of court.

I am wondering if CDS as a source of magnified leverage may be what the Fed is most worried about, but they can hardly say so without triggering a panic.

This is mainly the problem. CDPOs were set up with the explicit intention of magnifying leverage through CDS writes; many of them have blown up. This was also the issue the Canadian ABCP: supporters were basically fine with the underlying credit, but nobody wanted to put up the interim margin on the collateralization.

I’m wondering if AIGs CDS counterparties (long the protection) stand before or after capital holders (common, pref, sub debt, and debt)

They should stand ahead of everything, since any amount owed will be in the nature of trade. I’m not really familiar with the details of the AIG story; there may be some kind of ring-fence around the CDS liabilities, put in place to give some assurance that these liabilities would be honoured even if the sponsor went bust. Bear Stearns had a structure like that, which was never tested.

However, it gets complicated due to corporate structure. The actual insurance company is fine; but the Financial Products Group was, I believe, a creation of the holding company.

If you view writing CDS as roughly equivalent to being long a corporate bond, how do the capital requirements differ? Because CDS contracts only mark to market and don’t require additional capital, they amount (as AIG tried) to infinte leverage. Even if a bank buys a bond it has to count something for capital?

If I buy a corporate bond in my margin account (depending on the time to maturity), I can only get maybe 5X leverage (I have to put up 20% of capital). Banks can probably do 10-30X leverage (put up as little as 3% of the purchase price) buying bonds. If they have to put up zero margin (outside mark to market), they have infinite leverage — which, as the brokers might say — is trading on the government’s capital.

If you view writing CDS as roughly equivalent to being long a corporate bond, how do the capital requirements differ?

They don’t (except with respect to the separate leverage ratio in the States).

However, AIG wrote these swaps through an unregulated entity and, as I understand it, would only write contracts they were not required (by their counterparties) to collateralize.

Banks can probably do 10-30X leverage (put up as little as 3% of the purchase price) buying bonds.

AAA credits attract a 20% risk-weight and therefore can be levered 50:1 against Tier 1 Capital while maintaining a 10% Tier 1 Ratio. In the cash market in both Canada and the US, however, you’d run up against the leverage ratio or Assets-to-Capital-Multiple of 20x first.

A very beautiful explanation all around.

If I understand it then, we only have to worry about the non-bank CDS writers (like AIG) who don’t have to put up collateral in excess of mark to market. And presumably European banks (Swiss UBS without a leverage cap?). Would holding companies (e.g. Citigroup as opposed to Citibank) be engaged in CDS writing? Would Warren Buffett be writing them at the holding company level or the insurance sub? Any idea of what fraction of the CDS market nonregulated banks are?

I just keep thinking about how derivatives can bite the unsuspecting. I believe metals producer Metallgeschaft IG went bankrupt selling its metal production forward via futures contracts and got killed when the market went up and they couldn’t post more collateral until they produced the stuff.

It’s fair to say we’ve had an explosion of CDS in only a few years, and rapid adoption of any novel financial asset has a disturbing tendency to blow up once in a while because not everybody understands the risks.

There’s a Felix Salmon post What’s happening to Berkshire Hathaway? from last November, trying to unravel the reason why CDS on BRK (not written by BRK) were trading at junk levels. It’s a tangled world!

Fitch downgraded BRK today … although it doesn’t say so in so many words, there is an implication that these are written at the Holdco level.

I believe – but I’m not sure! – that Bank Holding Company’s are regulated by the Fed and have limits on what they can do. Anybody supplying good links about this will be thanked!