DBRS has published a newsletter highlighting Canadian bank capital levels, which is interesting in the light of their Review-Negative of non-Equity Tier 1 Capital.

They make the following rather curious statement:

DBRS believes the bank’s ability to access the capital markets for funding in good and bad times is an importantconsideration in its capital profile.

Well… has the ability of the banks to access capital markets in bad times really been tested? “Challenging” times, OK. “Difficult” times, why not? But can the past two years really be described as “bad” for Canadian banks?

They note:

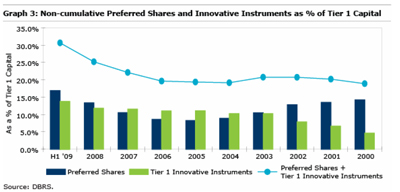

The mix, quality and composition of capital are other important considerations in the overall assessment of capital. Thequality of capital has been a key rating consideration in DBRS’s assessment of Canadian banks for an extended periodof time. DBRS has a preference for common equity over hybrids, as the first loss cushion for bondholders and othersenior creditors. On average, 17% and 14% of the regulatory Tier 1 capital is made up of preferred shares andinnovative instruments, respectively, which DBRS views as reasonable. DBRS expects the quality of capital to remainrelatively steady given the recent focus by the market on “core capital,” although OSFI does allow this percentage tonow go as high as 40%, up from 30% as of November 2008.