Brookfield Asset Management and Brookfield Infrastructure Partners has announced:

that they have signed an agreement with Babcock & Brown Infrastructure (ASX: BBI) (“BBI”) to sponsor a comprehensive restructuring and recapitalization (“Recapitalization”). BBI has a diverse portfolio of transportation and utility assets located in Australia, the U.S., the UK, continental Europe, New Zealand and China.

Under the agreement with BBI, Brookfield Asset Management and Brookfield Infrastructure (collectively, “Brookfield”) have jointly and severally subscribed for a proposed investment in stapled securities and assets of BBI of approximately US$1.1 billion. The proposed investment is comprised of the purchase of approximately A$625 million to A$713 million (~US$555 million to $635 million) of stapled securities for a 35% to 40% interest in the restructured BBI and A$295 million (~US$265 million) for the direct purchase2 from BBI of a 49.9% economic interest in Dalrymple Bay Coal Terminal (“DBCT”), in Queensland, Australia, and 100% of PD Ports, a leading ports business in northeast England. Immediately following the purchase of PD Ports, Brookfield will repay £100 million (~US$160 million) of debt at PD Ports.

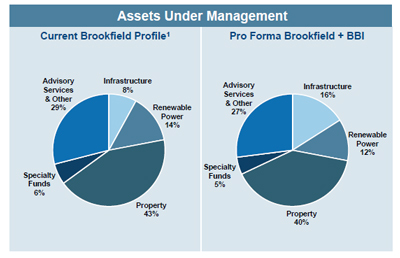

Brookfield’s Investor Presentation includes the following graphic:

DBRS views this plan as neutral to Brookfield’s ratings providing it (i) is not required to acquire any additional portion of the investment that BIP does not acquire and (ii) maintains sufficient liquidity at the corporate level while supporting the BBI restructuring program. At the end of Q2 2009, Brookfield had over $800 million in cash and financial assets on hand as well as bank lines at the corporate level, plus access to ongoing cash flow and other forms of liquidity within the Brookfield group. DBRS would view negatively a combination of this plan along with any other acquisitions that together puts pressure on Brookfield’s liquidity at the corporate level.

The following BAM preferred shares are tracked by HIMIPref™: BAM.PR.B, BAM.PR.E, BAM.PR.G, BAM.PR.H, BAM.PR.I, BAM.PR.J, BAM.PR.K, BAM.PR.M, BAM.PR.N, BAM.PR.O and BAM.PR.P.

[…] We will see more of this as the smoke clears – we saw some yesterday with the BAM acquisition of BBI. […]