The bank regulators have spent the past few years decrying regulatory arbitrage – the idea that differing jurisdictions can have different rules. Looks like regulatory arbitrage will increase:

Prime Minister Gordon Brown distanced his government from proposals by President Barack Obama to split up banks, saying nations require solutions tailored to their own needs.

Brown’s plan to force banks to detail how they’d unwind in case of their demise is strong enough to protect the U.K., spokesman Simon Lewis told reporters today in London. In contrast, the opposition Conservative Party, said it wanted “Obama-style regulation” to prevent future banking crises.

…

Brown’s response underscores the failure of leaders to develop a coordinated approach to global banking regulations and opens a battle line with the Conservatives before an election that must be held by June. Opposition leader David Cameron praised the bid to keep banks from the “casino operations of proprietary trading.”The Financial Services Authority, the U.K.’s banking regulator, called the U.S. plans “interesting.” FSA Chairman Adair Turner, who heads a committee examining the issue for the Financial Stability Board, which guides policy for the Group of 20 Nations, opposes a legal split of deposit-taking and trading units, and argues that capital charges on bank trading books help curb excessive risk.

Mind you, nobody knows the definition of proprietary trading:

Other analysts pointed to uncertainty surrounding the detail of Obama’s plan. “We are in the dark as to how proprietary trading activities can be effectively distinguished from Treasury activities and the risk-assumption inherent to market making,” analysts at Keefe, Bruyette and Woods Ltd. said in a note today.

Since prop trading will be allowed if it done to serve customers, and since a counterparty to a trade necessarily has a trading account with the bank and since somebody with an account is by definition a customer … a broad interpretation will have no effect whatsoever!

The Bank of Canada has published a working paper by Teodora Paligorova titled Corporate Risk Taking and Ownership Structure:

This paper investigates the determinants of corporate risk taking. Shareholders with substantial equity ownership in a single company may advocate conservative investment policies due to greater exposure to firm risk. Using a large cross-country sample, I find a positive relationship between corporate risk taking and equity ownership of the largest shareholder. This result is entirely driven by investors holding the largest equity stakes in more than one company. Family shareholders avoid corporate risk taking as their ownership increases unlike mutual funds, banks, financial and industrial companies. Stronger legal protection of shareholder rights is associated with more risk taking, while stronger legal protection of creditor rights reduces risk taking.

Hmm …. so the Bank Act, with its restrictions on control, serves to increase the propensity for risk taking by banks …. hmmmm …

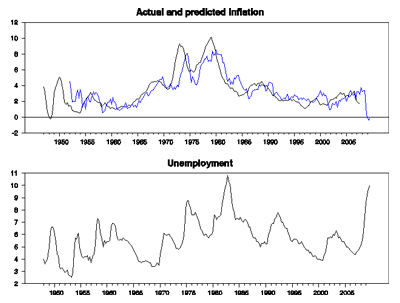

Econbrowser‘s James Hamilton takes a look at inflation fears and concludes that we don’t need to worry … yet:

Inflation is not something you should be afraid of for 2010. But what we need is a convincing commitment from the government to both near-term stimulus and longer-term fiscal responsibility in order to be assured that it’s not a concern over the next decade.

And that’s not what I’m seeing from the U.S. Congress.

POW.PR.C continued to trade well in excess of its normal volume but the peak of the idiocy appears to have passed. Moody’s massive downgrade of BMO Prefs did not have any immediate effect on their price.

Volume declined a little but remained elevated, as PerpetualDiscounts gained 6bp and FixedResets lost 5bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 1,707.7 |

| FixedFloater | 5.72 % | 3.80 % | 34,280 | 19.27 | 1 | -1.0417 % | 2,762.3 |

| Floater | 2.30 % | 2.64 % | 108,394 | 20.66 | 3 | 0.0000 % | 2,133.5 |

| OpRet | 4.85 % | -7.18 % | 112,247 | 0.09 | 13 | 0.2872 % | 2,318.8 |

| SplitShare | 6.38 % | -1.05 % | 171,103 | 0.08 | 2 | -0.3289 % | 2,106.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2872 % | 2,120.3 |

| Perpetual-Premium | 5.82 % | 5.84 % | 152,264 | 13.85 | 12 | 0.0309 % | 1,886.1 |

| Perpetual-Discount | 5.76 % | 5.80 % | 181,718 | 14.19 | 63 | 0.0556 % | 1,825.5 |

| FixedReset | 5.42 % | 3.60 % | 347,519 | 3.83 | 42 | -0.0542 % | 2,180.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| NA.PR.L | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-22 Maturity Price : 21.54 Evaluated at bid price : 21.83 Bid-YTW : 5.55 % |

| BAM.PR.G | FixedFloater | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-22 Maturity Price : 25.00 Evaluated at bid price : 19.00 Bid-YTW : 3.80 % |

| CM.PR.K | FixedReset | -1.00 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 3.74 % |

| RY.PR.H | Perpetual-Premium | 1.01 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-23 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 5.61 % |

| ENB.PR.A | Perpetual-Premium | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-22 Maturity Price : 24.85 Evaluated at bid price : 25.06 Bid-YTW : 5.57 % |

| BAM.PR.J | OpRet | 1.79 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 26.11 Bid-YTW : 4.82 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.X | FixedReset | 177,025 | RBC crossed 11,000 at 27.75; Desjardins crossed two blocks of 80,000 each, both at 27.80. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.70 Bid-YTW : 3.58 % |

| TD.PR.M | OpRet | 120,100 | RBC crossed blocks of 48,800 and 61,200, both at 26.16. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-02-21 Maturity Price : 26.00 Evaluated at bid price : 26.25 Bid-YTW : -8.46 % |

| TD.PR.G | FixedReset | 107,080 | Nesbitt crossed 100,000 at 27.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.82 Bid-YTW : 3.46 % |

| RY.PR.T | FixedReset | 42,370 | RBC crossed 15,000 at 27.62. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.70 Bid-YTW : 3.63 % |

| TRP.PR.A | FixedReset | 39,470 | TD crossed 10,400 at 26.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.96 Bid-YTW : 3.82 % |

| BAM.PR.R | FixedReset | 36,400 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-01-22 Maturity Price : 23.25 Evaluated at bid price : 25.52 Bid-YTW : 4.77 % |

| There were 40 other index-included issues trading in excess of 10,000 shares. | |||

Why would you buy BAM.PR.R yelding 4.77% which is perpetual, when you can buy BAM.PR.J yelding 4.82% and is retractable in 2018?

I wouldn’t!

To be fair, my calculation of YTW is idiosyncratic and may have large effects on the calculated YTW of instruments trading relatively close to par, such as BAM.PR.R.

BAM.PR.R is callable 2016-6-30; due to matters of programming convenience (discussed on another post) I calculate the yield to this call based on a pay-date of 2016-7-30. That causes a minor difference from what others might calculate.

A larger difference is caused by my assumption of a limitMaturity price thirty years hence of 23.25. This adjustment in end-price is an attempt to incorporate some scenario analysis into the YTW calculation. Since in the “good” scenarios the issue will be called, the limitMaturity price will be dependent upon the “bad” scenarios, in which spreads increase. I plug in a price of 23.25 as my ending price, where others may wish to plug in other prices for this scenario – such as the current bid of 25.52.

BAM.PR.R will reset to GOC5+230 on 2016-6-30 if not called; still others may take exception to my assumption that the GOC five-year rate at that time will be the same as the five-year rate now: I’m plugging in 2.46% for that value, resulting in a divided rate of 4.76% of par after the reset, which is applied until the limitMaturity of the issue (compared to the initial fixed rate of 5.4%).

In short, YTW calculations require a certain number of assumptions, especially for instruments of this nature which have extensions and resets. I report values based on the assumptions I use in my analysis, which is performed via my firm’s analytical software, HIMIPref™. Those who wish to experiment with the effect of changing these assumptions are free to do so with the FixedReset Yield Calculator that I have made available (for the permanent link, see the right hand panel of PrefBlog under “On-Line Resources”).

To get back to your basic question, however, regarding why people buy BAM.PR.R in preference to BAM.PR.J, voluntarily taking on extension risk for, at best, a few beeps in yield … I just don’t know. The situation is also noticable when comparing the BPO FixedResets vs. its retractibles. I discussed some elements of the psychology in my essay Break-Even Rate Shock.