I’ve been interested in this topic for a while (due to the prevalence of covered call writing strategies in SplitShare corporations) and now (with a hat tip to Financial Webring Forum) I’ve found a study on historical index performance, Passive Options-based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index:

This paper assesses the investment value of the CBOE S&P 500 BuyWrite (BXM) Index and its covered call investment strategy to an investor from the total portfolio perspective. Whaley [2002] finds risk-adjusted performance improvement based on the BXM Index in individual comparison to the S&P 500. We replicate this work with a longer history for the BXM Index and with the short but meaningful history of the Rampart Investment Management investable version of the BXM. We use the Stutzer [2000] index and Leland’s [1999] alpha to assess risk-adjusted performance taking the skew and kurtosis of the covered call strategy into account. Additionally, we compare standard investor portfolios to portfolios where BXM has been substituted for large cap assets and find significant risk-adjusted performance improvement.

The compound annual return of the BXM Index over the almost 16-year history of this study is 12.39%, compared to 12.20% for the S&P 500. Risk-adjusted performance, as measured by the Stutzer index, is 0.22 for the BXM versus 0.16 for the S&P 500 [monthly]. Leland’s alpha is 2.81%/yr. The tracking error of the Rampart investable version of the BXM (1.27%/yr) is found to be credible evidence of the investability of the BXM Index.

Known sources of BXM return are reviewed and behavioral factors that may have enhanced BXM performance are considered.

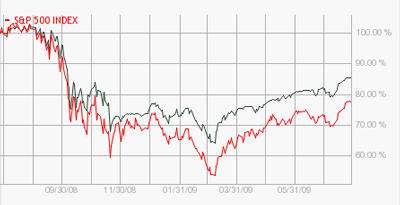

Surprisingly – to me – performance relative to the S&P 500 seems to have held up through the massive gyrations of this spring:

Five Year Chart

One Year Chart

The CBOE has a web page devoted to their BXM index. There is another index created through cash covered put writing.

Update, 2009-9-29: Assiduous Reader prefhound has commented on BXM on another thread.