Performance of the HIMIPref™ Indices for April, 2009, was:

| Total Return | ||

| Index | Performance April 2009 |

Three Months to April 30, 2009 |

| Ratchet | +11.53% * | +13.98% * |

| FixFloat | +11.53% ** | +13.36% ** |

| Floater | +11.53% | +28.50% |

| OpRet | +3.12% | +5.65% |

| SplitShare | +7.40% | -1.35% |

| Interest | +2.68% | -1.27% |

| PerpetualPremium | +8.84%*** | +5.65%*** |

| PerpetualDiscount | +8.84% | +5.65%% |

| FixedReset | +6.27% | +7.87% |

| * The last member of the RatchetRate index was transferred to Scraps at the February, 2009, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| ** The last member of the FixedFloater index was transferred to Scraps at the February, 2009, rebalancing; subsequent performance figures are set equal to the PerpetualDiscount index | ||

| *** The last member of the PerpetualPremium index was transferred to PerpetualDiscount at the October, 2008, rebalancing; subsequent performance figures are set equal to the PerpetualDiscount index | ||

| Funds (see below for calculations) | ||

| CPD | +6.93% | +6.34% |

| DPS.UN | +7.72% | +5.55% |

| Index | ||

| BMO-CM 50 | +6.37% | +5.08% |

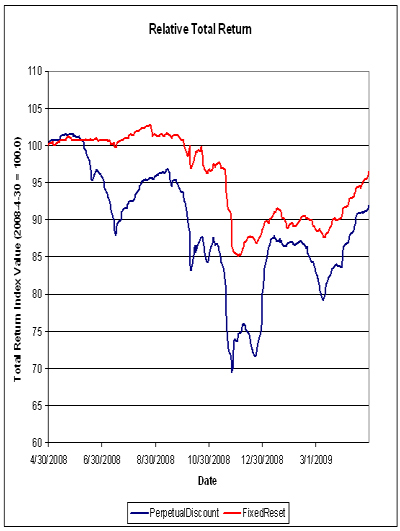

The recent rally has been most welcome, but we’re still a long way from where we were:

Claymore has published NAV and distribution data for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to April 30, 2009 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| January 30, 2009 | 14.57 | 0.00 | ||

| February 27, 2009 | 14.40 | 0.00 | -1.17% | |

| March 26 | 14.19 | 0.2100 | 0.00% | +0.63% |

| March 31, 2009 | 14.28 | +0.63% | ||

| April 30, 2009 | 15.27 | 0.00 | +6.93% | |

| Quarterly Return | +6.34% | |||

The DPS.UN NAV for April 29 has been published so we may calculate the March returns (approximately!) for this closed end fund.

| DPS.UN NAV Return, April-ish 2009 | |||

| Date | NAV | Distribution | Return for period |

| April 1, 2009 | 16.02 | 0.00 |   |

| April 29, 2009 | 17.07 | 0.00 | +6.55% |

| Estimated April Beginning Stub | +0.77% | ||

| Estimated April Ending Stub | +0.33% | ||

| Estimated April Return | +7.72% | ||

| ** CPD had a NAV of $14.39 on April 1 and a NAV of $14.28 on March 31. The return for the day was therefore 0.77%. This figure is added to the DPS.UN period return to arrive at an estimate for the calendar month. | |||

| ** CPD had a NAV of $15.22 on April 29 and a NAV of $15.27 on April 30. The return for the day was therefore +0.33%. This figure is added to the DPS.UN period return to arrive at an estimate for the calendar month. | |||

| The April return for DPS.UN’s NAV is therefore the product of four period returns, +0.77%, +6.55% and +0.33 to arrive at an estimate for the calendar month of +7.72% | |||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for February and March:

| DPS.UN NAV Returns, three-month-ish to end-April-ish, 2009 | |

| February-ish | -1.79% |

| March-ish | -0.23% |

| April-ish | +7.72% |

| Three-months-ish | +5.55% |

As an Assiduous Reader, I must pay my dues by pointing out the typo in:

** The last member of the FixedReset index was transferred to Scraps at the February, 2009, rebalancing; subsequent performance figures are set equal to the PerpetualDiscount index

which should read FixFloat instead of FixedReset.

Adrian

As an Assiduous Reader …

An Assiduous Proof-Reader, in fact! Thanks! It has been fixed.

[…] remained steady in April, with portfolio turnover of about 80%, as the market strongly advanced in a very consistent fashion: PerpetualDiscounts had only three down-days, against 18 […]

[…] as it was for the strong performance of the preferred share market. As noted in the report of Index Performance, April 2009, the PerpetualDiscount index experienced only three down-days in the month, compared to eighteen […]

[…] of their run-up today and Fixed-Resets were able to catch up a little in performance following a very good month – and Month-to-Date – for the market in general, amidst continued heavy volume. PerpetualDiscounts […]

[…] Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for March and April: […]

[…] to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for April and […]